My $10k New Years’ Resolution Update: Did I Get It?

In January 2021, I declared I’d make it a resolution to earn $10k in side income, separate from my full-time gig. I definitely didn’t need a side gig with my high salary, but I went for it for a few different reasons. Namely, I wanted to experience doing it for myself. Doing this 10k update is both accountability for myself and showing off the results for you.

And the results are officially in!

Happy to say that:

✨I succeeded in reaching my goal✨

… if you count my tax return of $1,297.

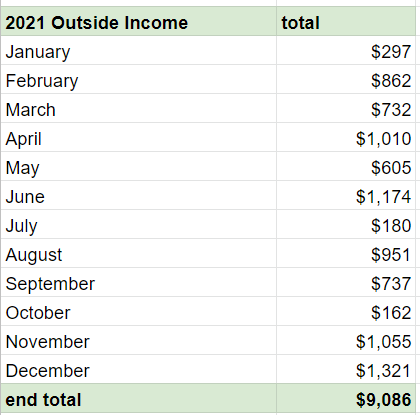

Meaning I didn’t quiiiiiiite reach it. My side-income spreadsheet tracker tells me I ended up making a total of $9,086 in side income in all of 2021 (screenshot below). Nothing to sneeze at, but still below my original goal. I only crest over that number if you count how much money I got as a tax return; since your tax returns are the money you earned the previous year (aka, not 2021) I don’t think it exactly counts in this instance.

Now, I don’t consider this much of a failing. I wasn’t relying on this extra income to survive, which has a lot to do with the fact I got outrageously lucky with many of life’s rolls of the dice. That means there wasn’t much at stake if I didn’t reach my goal; this definitely had a lot to do with my falling short of it, as I didn’t need to sacrifice things like my mental or physical well-being in the pursuit of more dollars.

In pandemic times, that’s a very privileged position to be in.

Way too many employees in America have to deal with pressure to work under COVID conditions. Add to that the shitty policy of no required sick days by law, and you’ve got literal millions stuck between getting sick and getting bankrupt. Which, by the way, should make The Great Resignation a lot less shocking.

I bring this up because I had planned to pick up a weekend gig as a holiday worker in December. Besides that, I had also planned to flip a few things that would make lovely Christmas gifts. After coming down with COVID myself in early December, my plans to offset that $914 shortfall went up in smoke. No weekend store work, or flipping, for me. Now I’ve got several odds and ends cluttering up my apartment to get rid of, to boot. C’est la vie, I guess.

That was a good lesson to learn: have a backup if something doesn’t fall through. I had thought just diversifying where I got money from was enough. While it definitely helped, it also meant I was stretching myself across very different income streams. The passive stuff, like dividends and bank account bonuses, didn’t balance out the active stuff like flipping on top of my day job.

There were quite a few other lessons this experiment drove home for me:

Side income is fucking hard to earn.

It’s a lot less organized than my full-time work, which has a whole team of people to figure out my pay. Now I have to be the one to collect the pay, deposit the pay, and make sure I’m actually being paid… on top of doing the actual work. I do not like chasing people to pay me for my labor.

This likely would’ve been more streamlined if I was established in whatever discipline was paying me (be that flipper, freelance marketer, what have you). Since I didn’t have those connections as a newbie, there were some time opportunity costs in proving my trustworthiness. Not fun at all.

Pandemic stress made it hard to do much of anything.

I had to pull the brakes on the number of articles I wanted to write because I didn’t have the mental energy to do it. Same thing went with the amount of time I had originally planned to dedicate to getting side hustle income. The Darcy of January 2021 was more starry-eyed than the Darcy of January 2022. While I’ve still got plenty of constellations in these ol’ face orbs, I now know also not to underestimate how much worrying about the health of myself and others can take a toll.

Life got in the way, including a sickness.

This bears repeating. Guys, I had these grand plans of becoming a holiday worker on the weekends and crest over my $10k goal easily, thanks to wages being a little more in line with what they should be. Instead, I caught a case of COVID and was forced to Not Do That. I couldn’t even sell off the things I was specifically saving for the holiday season to flip, like several board games. Now they’re sitting patiently in a pile as I decide a new strategy for selling them.

How I Made Over $10k in One Fell Swoop

Funny enough, the $9k I did manage to wrangle couldn’t hold a candle to the bonus I got in my 9-5 role. I was paid over $13,000 in February of 2021, which was the biggest bonus I’ve ever gotten in my life. It didn’t count towards this resolution because it was through my day job. The executive team decided to give me a phat bonus after the hell of 2020, a big chunk of it going straight into my 401(k). The rest got put towards buying my car, which was a fantastic purchase in pandemic times.

Getting that bonus really demonstrates I get the most profit from my time by sticking to the moneymaker: my full-time work. Focusing on my big-girl job will give me much more than side hustles do, and much sooner too. If I had counted this bonus towards my goal, you’d have seen a sheepish article a month after announcing the resolution going “well… I did it”.

“But not in a way accessible to most.”

The $10k Overview

I’m glad I did it as a learning exercise. I have learned I do not like being a freelancer. My energy is limited as is; without the additional depletions from living through a pandemic and watching others struggle hard with mental health and inadequate wages. I now know I’d prefer keeping my cushy job as opposed to going the entrepreneurial route. Neither route is for everyone, so it’s good to know where I personally stand.

I’m also very glad I didn’t need to do this as a means of survival. That’s the privilege and luck coming into play. It made it abundantly clear adding a side hustle of this magnitude is beyond exhausting. I am not immune to burnout and need my rest, just like everyone else. I don’t use caffeine either (shoutout to my coffee drinkers, aay) so I need even more sleep than the dismal average.

It’s sad to see that physically, only a very few can manage a full time job and a side hustle without some kind of drug aid. My drug was sugar; I ate so much junk food after being too stressed to care about healthy eating. I’m taking this off my plate in 2022, which I’m hoping is enough of a change to get me back on the health bandwagon.

Am I doing this again? Hell fucking no. I’m at a point in both my career and net worth trajectory to really not need this. Would it help move the needle to reach financial independence? Sure, but not by much. I could shave maybe another year off at this rate, which isn’t worth it to me. I’m cool with an extra year of building if it means I do not run myself into the ground. Thanks for the teachings!

Cover image credit: Evan Dennis via Unsplash

What a great post. I hate to admit this but when I crossed $200,000K (early 2021). I lost my crazy FIRE mojo. My full time job plus all the side contracts for editing (audio and video) became a drain. The extra money no longer motivates me the way it did when I was working toward $100K. Secretly, I hope the desire to work through my nights and weekends is rekindled one day because I did love how fast my net worth was growing.

My plan was to keep up my crazy FIRE 🔥 pursuit until I reached $500K then slow down. Comfort is so hard to overcome.

Your Blog is Amazing! Long time reader wishing you continued success.

Whew, this gave me a blast to the past in 2017 when I got a raise at work (went from $15 an hour to $20, utterly rolling in it). Once I realized that was more than what I’d typically make with my weekend gig, I was immediately ready to never work weekends again. Funny how hitting a certain finance level changes things when you didn’t think it would!