A $200000 Net Worth Update: Oh, We’re on the Accelerated Path

And just like that, I’m now at a $200000 net worth. The last time I hit a $50k milestone it took ten months to do it; this time around it took a little less than six. In other words, my six-figure net worth f***ing doubled in less than two years. Really goes to show how your money can work for you if you know both what to do with it and what it means.

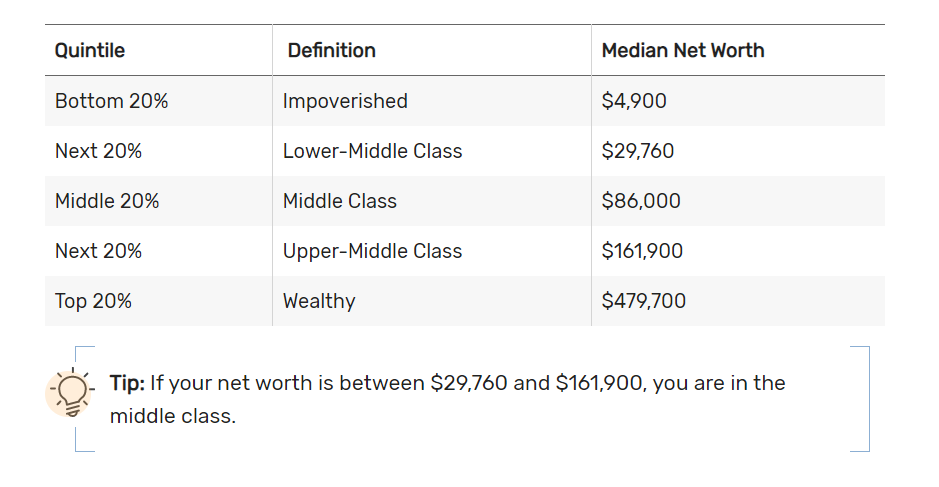

First things first: this $200,000 net worth puts me solidly in the upper middle class. In fact, I had been part of the upper middle class since about October, according to the chart below:

Upper Middle Class

Which begs the next question: what does being upper middle class mean? When I was growing up the class hierarchy was presented as rich, middle-class, and poor. “Upper middle” is mostly used as a term in academia to further categorize the diversity, I guess, of the middle class. Nina, the family friend I’ve talked about before, had another term for it she proudly called me: “upwardly mobile”.

From my non-academic point of view, that’s the definition that best fits. If you’re upper middle class, you are upwardly mobile. Upper middle-class people are the ones buying nice homes in amazing school districts for their kids. They’ve got really nice things and are always smartly dressed, even when they’re just lounging about at home. You are flirting with entrance to the upper class, with access to swanky events and networks that are now, at least, open to you. You might not be at the penthouse level, but you’re still so high up that the city is laid bare below. A million-dollar house is suddenly an easy endeavor – you’ve got enough cash for a 20% down payment, after all. Heck, you’re now 1/5 of a millionaire with that kind of dough; play your cards right and you’ll be a millionaire within the next decade, easy.

Financial Talk

I’m really not kidding about that all, by the way. 20% of a million is $200,000, meaning you too can start touring homes like these while house hunting:

Being upper middle class can get me some other awesome perks:

- $20,000 average growth per year when invested in index funds;

- Becoming a millionaire at 45 years old, assuming I never contribute another dime, or;

- Blowing it all on 61,000 chips and guac orders at Chipotle.

Guys. Including my annual bonus, and bank account churning, I’m slated to hit $95,000 in income this year. That’s a LOT of money to spend on whatever I want. And because I’ve got all this moolah now at my disposal, I don’t strictly have to save any of it. Obviously the responsible thing is to always save and invest; that’s a no-brainer. The difference here is I’m not going to shoot myself in the foot for failing to save up. Maybe being upper middle class is the formal designation for “finally seeing money as a friend, not as a tool for fear”.

Let’s talk for a second about losing that fear. With this milestone I know now that even a serious recession won’t really faze me. This is true even if we have a repeat of the 2008 recession, where millions saw their net worth drop by 50%. Well, guess what: I’d STILL be worth six figures even in that scenario, which remains an excellent position to be in.

The Dark Side to This

Make no mistake, I’m not some rugged individualist who yanked this $200000 net worth out of the ground. I had significant help to reach it, including substantial college scholarships and government bailouts. These are both valuable resources that are, more and more, being denied to big groups of people.

All of this was further exacerbated, too, with the COVID pandemic. Now that I’ve “officially” joined the upper middle class, I can officially point to how weird of a position it is to be in. A Purple Life already beat me in discussing the weirdness of having this label, which can make you uncomfortable after a lifetime identifying as something else:

Life is weird. Classifications are weird. Putting my partner and I in arbitrary brackets shouldn’t create this much upheaval in my mind…but it does. […] People are usually biased with how they see themselves and think of other people as the “lucky” and “rich” ones without taking a proper look at themselves – everything is placed on an “other.”

It’s an interesting dilemma.

It’s a real worry that you might lose touch with reality once it starts not affecting you so much. During the pandemic several upper middle-class people felt “guilty” they weren’t really affected by the state of the world. When you’re upper middle class, after all, you’re likely working in a white-collar role that’s easy to take remote. You can easily switch to grocery delivery and limit all physical, germy contact with the outside world. And if quarantine ever becomes too much for you, hey! Go take a spin in your nice car, or rent an even nicer one and drive wherever you please!

The upper middle echelons are not yet joining the 1%ers on cruises or private island getaways; they’re also not ignoring the plight of those suffering around them as the filthy rich tend to. Because of this they become very aware of how unfair the system is. Their eyes are opened to how favorably it’s treated them, whether that’s deserved or not. They’re also unsure of how to deal with this information – with luck such a big part of success, what qualifications do they have for helping others on this path? From what I’ve seen, that same guilt often leads to resentment against feeling guilt at all – and that leads to a two-faced dynamic of performative compassion.

Sometimes I feel like a wildlife biologist when I’m exploring my very upper middle class/upper class city (Newton, MA). The folks around me are proudly planting Black Lives Matter signs in their yards and petitioning City Hall to defund the police; this is coupled with heavy opposition to build affordable housing and hate-related incidents continuing to rise. It’s very much up to me to make sure I don’t start embracing this progressive/regressive dichotomy.

Real Talk

All of that guilt and resentment, however, will only bubble up if you get used to your $200000 net worth position. Right now I’m still in the stage of feeling overwhelmed over it. To the point that I almost can’t finish this blog post, I’m that shook.

Do you ever learn about a subject and study it so in depth you become one of the more informed people on the topic? And then you write about it for over a year, getting published on multiple sites and getting award/documentary nods? And then it’s not until almost half a decade rolls by that you’re suddenly overwhelmed with how much your choices around this topic have positively impacted your life trajectory?

Because this all hit home for me a few weeks back, when I realized I’d be hitting a $200k very soon. If you counted the value of everything I own (yes, including the stuff I got for free) I likely hit that $200000 net worth even earlier. Overall it’s a phenomenal position to be in; all I have to do is stay the course and my life will keep coming up aces.

Dang, how long do you think it’ll be until I hit the next milestone? Guess we’ll see what happens on this accelerated path to wealth.

Cover image credit: Alex Robert via Unsplash

Congrats on the $200K mark and how quickly you were able to achieve it! Where did you get the Upper Middle Class graphic above? The definition of Upper Middle Class varies by location and source. The graphic states $29,760 is middle class – a new SUV would eat up all of that. And buying a $1M property with $200K in assets still requires PMI after closing costs. Don’t forget prolonged unemployment and health problems can burn funds. I’m not to rain on your parade, but bring you down to earth a little bit (since you admit to being shaken by it.) $200K is fantastic and commendable at your age, but there’s still a fine line between success and failure in the big picture. Staying healthy, staying married (or single) and staying out of debt is key.

Lots of great critique here! I’d love to see more comments like yours because they help better put this into perspective; warning you now, long response ahead.

Going in order: the graphic itself is linked to the article here, which is one of the few that categorizes class hierarchy according to net worth instead of income. I’m very surprised the most common yardstick is income; this greatly distorts the “high earning poor” (who make a ton of money yet still live paycheck-to-paycheck) and the heirs/heiresses who work low-paying jobs because they don’t have to make a lot of money (many become artists, freelancers, consultants, etc). And of course, when you’re putting together a net worth calculation based on a population 330 million strong, the generalization will cover a wide range of net worths.

“The graphic states $29,760 is middle class – a new SUV would eat up all of that.” I’d very sincerely hope no one is spending their entire life savings on a new car, especially when used cars go for much less. In fact, they may not even need a set of wheels at all, as I’ve discussed before. Reaching a high net worth is initially done by avoiding such pricey expenses in the first place; there are very few people who, at the end of the day, truly “need” a new SUV.

“And buying a $1M property with $200K in assets still requires PMI after closing costs.” Yes. My first job was with a luxury real estate company, so I’ve seen firsthand how expensive these home purchases become! The house mentions are more of an exercise in contextualizing the $200k. Of course there will be more of a “cost” to a house as expensive as that; if I do decide to buy a million-dollar home, it won’t be anytime soon.

“Don’t forget prolonged unemployment and health problems can burn funds.” This is another very important point to be made, as a serious medical emergency or accident could prevent me from continuing work entirely. Should that happen, I’d rather have the money to throw at it than not. There are millions out there who do not have that; in fact, most don’t have much saved up at all, who will really feel the burn if something catastrophic happens to them. That’s exactly why I run this site in the first place, so more folks will have the resources needed to become financially literate and (to quote you) end up “staying healthy, staying married (or single) and staying out of debt” for life.

I also see now I should’ve added to that list: I have enough money to live off of for over six years. These are cool thought experiments, but not what I actually plan to do.

You are doing great. The crazy thing about measuring wealth is you can make yourself feel rich by comparing with those behind you or terrible by comparing to those ahead of you. For instance, a lot of people think the true upper class are the one percenters. Their median net worth of $10,700,000 makes even most multimillionaires feel middle class. But the fact is that’s far more than most people need to fully fund their lives, probably more than ten times more. You are doing an outstanding job on both the income and the savings side of the equation. Plus you have a great outlook and attitude and a lot of self knowledge, those are the attributes that lead to a successful life.

Thanks so much Steve, you’ve always got a great outlook yourself 🙂

Congrats on the $200,000 net worth! (I know I’m late, I had the tab in my browser a long time).

I never really thought much about the label of upper-middle class. I’ve always just used it, because I know we’re doing much better than average, but we aren’t doctors, lawyers, NBA players, movie stars, CEO, CIOs, CFOs, etc. By this measure though, we passed wealthy more than a decade ago. I think age and region should play a role in the label.

If you are older (like me at 45), you’ve had that time for compound interest to take you to $1M. If you live in Newton, MA (where my wife is from and next door to my own Waltham roots), a $200K net worth can feel a little like a drop in the bucket due to the comparative wealth of the region.

At the end of the day, a label is just a label just like a rose by any other name. I hadn’t thought about it ever having a formal definition in academia, but it makes sense that it would.

And if you find yourself in Newport, RI, send me a message, I’ll give you some guac.