A $300,000 Update: We Want Guac Turns 3!

Guys, I have been waiting for this for months. Mostly because I’ve had this article drafted for months and have been impatient to finally publish it. And now I can, because as of today I officially have $300,000!!! Want to know what to do with $300k? Because I sure can tell you!

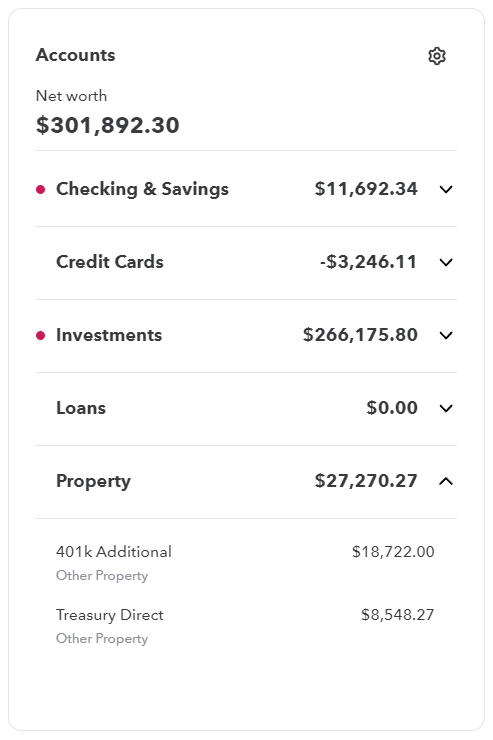

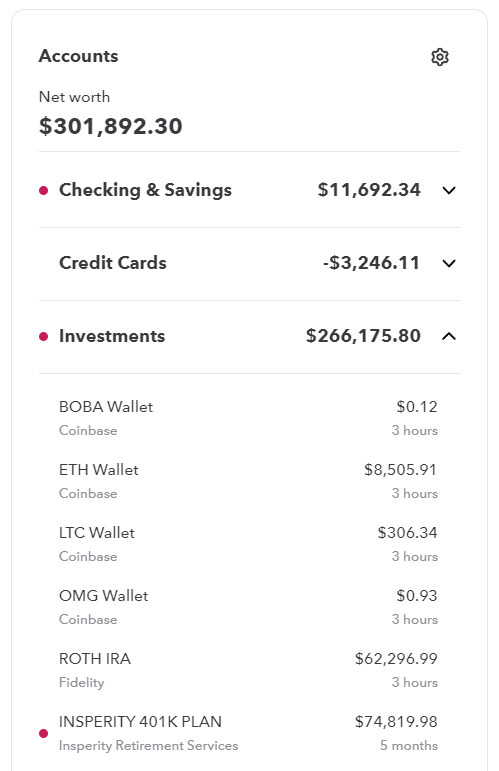

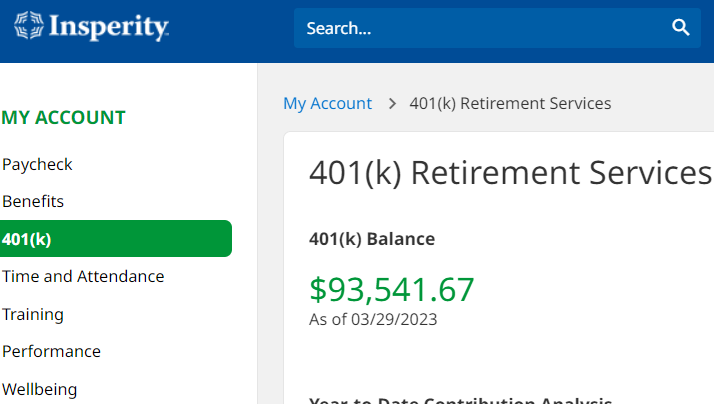

Note: my 401(k) stopped updating, so I’ve been tracking the difference as it’s grown under the “Property” section on Mint. Included the screenshot from my company provider for proof of the balance.

I have also been impatient for this milestone article because I had a fun idea some months back to celebrate reaching $300k when my blog is turning 3. Just ignore that my blog is actually 3 years and 3 months old. Or have fun noting it’s threes all the way down. Numerology fans, make yourselves known in the comments 😊

It’s really fascinating to me that my net worth has roughly kept on par with the age of this site. It’s also very funny to me that this has held true despite everything that’s happened since I published my first post. Back then, I had no idea of the shitstorms coming our way, the pandemic being the most notable.

This is the fourth net worth milestone I’ve hit while blogging. Going forward, I’ll start writing updates at every $100k mark instead of every $50k mark; since I expect the numbers to increase at a similar pace, it makes more sense to move the goalposts. In each update I’ll still note when I hit that $50k mark just to give y’all an idea of what the path to wealth could look like. I’ll also let Twitter and Instagram know if you’d like to follow me there.

But enough of that – let’s get into the numbers!

What Having $300k Means

With this $300k milestone I have officially reached the BonJoviFI of financial independence (FI) milestones!

Compound interest is ramping up here. For reference, my net worth during New Years was $273k after bouncing between $248k and $298k for all of 2022.

$10,000 is now roughly 3% of my net worth. $50,000 is a sixth, or roughly 17%. I now have double the amount of money I did in August 2020 and it keeps going up.

What this means in practical terms:

- If we’re using the 4% rule, I can withdraw $1,000 a month. This is the equivalent of working part-time making $11.50 an hour*, which is above the minimum wage in 35 states. This means that I have the equivalent of an extra “income” in my household, if someone was giving me 100% of their wages from their part-time job.

- Further significant, this $1,000 a month covers roughly all of my recurring monthly expenses besides rent. ($300 groceries, $25 cell phone bill, $200 giving, $85 auto + rent insurance, and $400 for the miscellaneous like doctor copays, restaurants, shopping, gas, or entertainment.)

- $30k of average growth per year. After graduating college, this is about how much I was making YEARLY with a 40-hour workweek at $15 an hour. (And pre-tax to boot.) Now, I’m seeing my investments essentially giving me my ENTIRE salary from 2016, on top of the salary I’m making now.

- Becoming a millionaire in 13 years (at 41 years old) without contributing another penny. That is a full 24 years before the “usual” retirement age at 65, giving me back decades of free time should I choose to retire early.

- If I lose half of my wealth in the next recession and somehow never get it back, I’ll still be worth six figures and still set to reach financial independence as a young’un.

What this means in fun spending terms:

- 150 vacations totaling $2k each. If each trip lasted one week, that’s almost 2 years’ worth of vacation. I can party hard for the rest of my 20s without ever going in debt.

- If I stick to a $30k yearly spend, and decide I’m going to rely on my net worth to fund my life, that’s a whole decade I – theoretically – could pay for.

- A 3 bedroom home in my state, IN CASH. Not Boston, but definitely Massachusetts! This includes places accessible by commuter rail, along with a ton of homes in Western Mass. And the Berkshires. You know how fancy I’d be if I could say “I live in the Berkshires”? I would be living.

- The down payment (20%) for a house worth $1.5 million. Even something “cheaper” in the $1 million range would be incredibly doable. As my last couple of milestone posts point out, I could be sitting pretty in some sprawling, castle-like abode for the rest of my days. At this point we’re getting into the range of houses that wouldn’t look out of place in a magazine because some celebrity just bought it. (This is also a bit too big of a mortgage to afford on my own, so it’s only here for strictly illustrative purposes.)

- Chips and guac at Chipotle cost $3.25. That means I can make over 92,000 orders and still not run out of money. If I ordered this three times a day, it would take me over 90 years to burn through my stash.

What to Do with $300k

As noted above, $300k can go towards a lot of varied, awesome things. In your 20s, the greatest action you should take with that much money is putting it to work as investments. I’m doing so with index funds tracking the S&P 500; this includes popular choices like Tesla and Microsoft while still being diversified in hundreds of other companies.

If I decide to only add three thousand dollars to my investments each year (or $250 a month) I will see my investments grow to $500k in five years with historical average stock market growth/the magic of compound interest. If I continue adding $3k each year after that, I will become a millionaire when I’m 40 years old.

Let’s say I choose to add ten thousand dollars each year instead. If I do so, I’ll reach a $500k net worth at 33 years old and a million at 39 years old. In other words, it it now well within my abilities to become a millionaire within the next ten years, all because I was able to reach a net worth total of $300k.

More calculations for higher savings would just show I’ll shave off more years until reaching a seven figure net worth.

The best answer to “what to do with $300k” is “let it make you a millionaire”. Sticking mine into stock market index funds will get me there sooner rather than later. Imagine what it would do for you when you don’t have to deal with a pandemic catching the world flat-footed.

Priority investment vehicles:

- 401(k) if your employer offers it, at least to get the company match. If not, you can ignore this.

- Roth IRA.

- HSA if your health plan offers it. If not, ignore.

- Taxable account.

All have their advantages and disadvantages (yes, including the taxable account) which I go into here.

I’m wondering now if I should start looking more closely at which account I’m putting money into. Since the very beginning it wasn’t much money, so the entire focus was “maxing all the tax-advantaged accounts I can, then turn to taxable”. Now that it’s a hefty amount, it’s got me wondering about whether that strategy is still right for me. If I end up deciding to retire early, I wouldn’t be able to easily withdraw money from my 401(k) and IRA; those usually require you to be a Certified Oldie™ to start taking cash out easily. I’ll definitely need to block out time to sit down and closely read what others, like the Mad FIentist, have written about this and report back on what I decide.

Looking Behind and Ahead

I started working towards financial independence when I was 22 years old. If this is really the halfway point to a million, I’ll be a millionaire when I’m 34 years old. I normally pride myself on optimism, so reaching that milestone at such a young age would make me cry and hyperventilate, in that order. It’s also a hell of a lot sooner than what I originally projected back in 2016; I specifically remember staring at Networthify and noting I’d be 45 years old when I reached financial independence. Obviously my income has since increased significantly since then, bringing the date at least a decade closer. It’s just that no one told my lizard brain yet, so I’m still assuming my 40s on some deep level.

Crossing this $300k threshold really fills me with peace of mind. Because I’ve been refining my financial strategy for years now, I feel comfortable knowing what to do with the $300k I now have. Whatever I choose to do in the next few years, it will be done with this rare and deeply valuable cushion supporting me.

Now on to the next $100k! Maybe it won’t take so long this time around 😉

*Pre-tax, to boot. Working 20 hours a week for $11.50/hour, with 52 weeks in the year, shakes out to earning $11,960 annually. The 4% rule here lets me withdraw $12,000, again pre-tax.

Cover image credit: Michael Balog via Unsplash

Congratulations! While the road has been bumpy and looks unpaved for the foreseeable future. You’ve still managed to build significant wealth. If you can build wealth during a bear market/recession there is no stopping you : )

This put a goofy smile on my face. What a great way to frame it 🙂

Next milestone: 400k when this blog turn 4!!! 🥳🥳🥳

Here’s to hoping!!! 🥂

Congrats on hitting the new milestone! You will join the double comma club before you know it!

Do your numbers include property equity (if have) Or is this invested assets only?

Thank you! I don’t own property so this only includes my cash and invested assets (401(k), Roth IRA, HSA, and taxable accounts along with government I-bonds and some crypto I need to sell one of these days). I played with the idea of including my car (a 2011 Nissan Rogue) in these calculations, but decided against it because I didn’t buy my car with the intent to use it as an asset.

Your blog is awesome!

I’m 22 years old and just hit the DemonFI !

Been able to put 100k$ in a year of savings.

You are a nice inspirational source. I don’t know anybody around me that is tracking is finance like that. (Got a excel with my real time networth lol)

Wow, huge congrats! DemonFI is where it’s at 😈

Congrats!!

I love referring to your list for mental check-ins, it’s fun 🙂 Though, my personalized twist on it is that I assign a quarter of our net worth per person since our NW has to cover four humans plus dog(s) if we were to retire early.

Hey, personal finance is personal so as long as it fits I love it! Thanks so much for the feedback friend!

You are on a roll!

Regarding your prioritizing different accounts, I found this post (below) on Our Next Life super helpful in figuring out some guidelines around how much we should contribute to the different retirement vs taxable brokerage accounts.

Basically Tanja talks about estimating how much you need to save in your Phase 1 (before 59.5 years) and Phase 2 buckets – using estimated expenses and different possible growth rates to identify how much money you need at X age to fund each phase. This post, and my subsequent personal calculations, were a major turning point in really seeing how much money would be available for spending at different points. What I found crazy was seeing that I needed nearly the name amount in each bucket (for me Phase 1 is ~15 years and Phase 2 estimated out for 40 years).

Pasted below because I never know if comment boxes will accept html 🙂

https://ournextlife.com/2016/02/17/how-we-calculated-our-numbers-for-each-phase-of-early-retirement/

This is EXACTLY perfect to what I wanted, thank you so much for the link!! Especially love Tanja’s projecting assuming they become centenarians, ha. I don’t think I’ll see that age thanks to last year’s diagnosis, but I know I have good genes thanks to all four of my grandparents living a long time, so… maybe they’ll balance each other out?? Regardless, her numbers have me excited to calculate mine. So glad you shared, friend 🙏