Let’s Talk Dividend Stock. WTF Is That and Should I Invest in Them?

Fun fact: I own dividend stock. Since I have most of my money invested in index funds, which track the overall market, that inherently means owning some stocks that pay me dividends. My taxable account alone (which has ~$120k in VTSAX) got me over $1,400 in dividends in 2021. My Roth IRA netted me another $764, which means I reached over two grand in completely passive income.

- Roth IRA dividends in 2021: $764.28

- Taxable dividends in 2021: $1,442.56

- Total dividends received: $2,206.84

If you wade through the newest personal finance rhetoric of crypto and (ugh) NFTs, you’ll also find quite a few folks building portfolios focused entirely on dividend stocks. Should you follow in their footsteps or stick with the old guard indexing?

What is a Dividend Stock?

First, a refresher on stocks. “Company stocks” are teeny-tiny shares of company ownership. Because you own the shares – or stocks – you own that part of the business. As a business owner, you can then benefit from that slice of ownership once the value of that stock rises. But be careful: that stock can also fall in value, so it’s important to only invest in stocks you believe will become more valuable over time.

Or be like me and bet on every company instead. Going with index funds that have stock in every publicly-traded company means I don’t have to do a ton of research and stock-picking 🙂

With that said, there are two types of stocks you’ll hear hotshot traders discuss without end: dividend stocks and growth stocks. Growth stocks refer to stocks that you expect will go up in price as time goes by. Growth stock in Company X, for example, might mean you buy it for $10 a share today believing it will go up to $20 a share, at which time you’ll sell your shares and reap the profit. Dividend stock, on the other hand, means you’re buying stock that will pay you for owning it. If you buy dividend stock from Company Y, they might give you $1 every quarter (or four times a year) for every 100 shares or so you own.

Stocks are usually defined depending on the overarching reason why people invest with them. While Apple ($AAPL) is a stock that pays you dividends, your average investor is usually buying that stock for the growth aspects, not the payouts. And while Chevron ($CVX) is pretty well-placed to crush their growth projections, their high dividend payout of 3.48% is going to attract a hell of a lot more dividend investors than any other.

If you want to get dividends from other sources, it’s not just stocks that offer them.

Bond dividends can be a thing too, they just pay pitifully little in comparison. In my portfolio, I currently have about $2,600 in a bond index fund (specifically FXNAX). In 2021, that’s netted me an average monthly dividend of $4; the total yearly dividend yield was $48.92. Pretty slick for bonds, sure. But my index fund with international stocks (FSPSX) got me $95.31 in dividends in Q4 alone (with the total funds in that sitting at ~$3,200).

Comparison

| Index fund name | Type (stock vs bond) | Dividend payout 2021 | % of overall value |

| FXNAX | Bond | $48.92 | ~1.9% |

| FSPSX | Stock | $160.65 | ~5.0% |

Bond dividends are a way to hold a conservative investment while also squeezing a little money out of it right now.

Which Type of Stock Should I Focus On?

For those out there who want to pick individual stocks, one of the considerations is around focusing on dividend stocks versus growth stocks. While I wouldn’t recommend stock picking, I would encourage you to figure out your comfort level. Do you get a thrill out of seeing dollars automatically hit your account? Dividends could be your bag. Don’t give AF either way? Growth might be your best bet.

But saying dividends are only about “getting paid now” is a little disingenuous. Collecting dividends from the stocks you own also means something pretty significant for any investor: creating a taxable event.

In the United States, dividends are taxed differently depending on whether they’re qualified dividends or ordinary dividends. Qualified dividends get special tax treatment, but still require you to pay tax if your overall 2022 income is over (roughly) $41,000. Everything else counts as ordinary dividends, which are taxes 10% at minimum. In contrast, growth stocks will only create a taxable event for you once you actually do sell the stock. Having much less paperwork to wrangle with is a valid reason for choosing growth stock over dividends, if you so wish.

How Do Dividend Stocks Perform?

In the short term, dividend stocks will give you a faster return with regularly-timed cash payouts. Growth stocks, in contrast, will likely take a while until you see the profit scale you want to. “A while” could mean a few months, a few years, or a few decades, depending on the company and your overall investment strategy.

For many investors, they view dividend stocks with a side eye. When dividend stocks do give their payouts to investors, their overall share prices drop. Why? Because in paying those dividends, the company you’re invested in now has said goodbye to million – or billions – of dollars in their cash reserves. That means they’re inherently less valuable, hence the drop in price. You might be getting $1 in dividends each quarter from Company Y, but those that earn more of the company are getting much more than that.

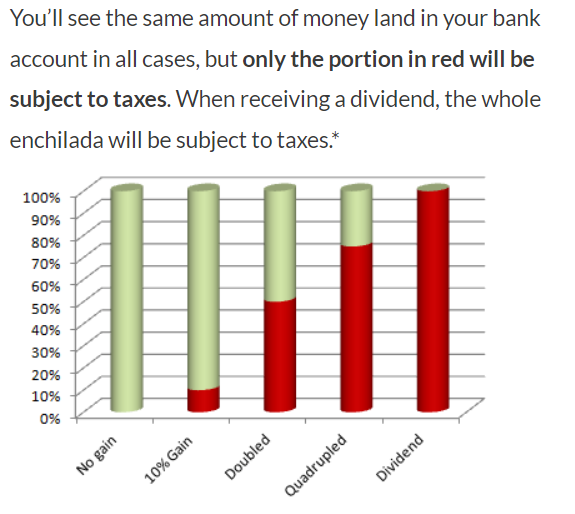

Interestingly enough, dividend stocks tend to have similar overall returns as growth stocks on aggregate. If a growth stock gains 10% more value in a year while a dividend stocks both gains 5% more value and pays you a 5% dividend, they both garnered a 10% return on paper. Difference is, the dividend stock here is guaranteed to trigger a taxable event. If you’re going to keep your money for several years, this means paying tax when you don’t strictly have to. That can create a tax drag on your portfolio, as Physician on FIRE illustrates:

Avoiding this tax drag means jumping through quite a few hoops or employing further strategies. This might include moving to a state with no income tax (there are a few!) or ensuring your income is low enough to stay in the lowest tax bracket possible. But that requires a lot more energy to pull off year after year.

That’s not all!

There’s another significant reason why investors give dividend stocks the aforementioned side-eye. For companies that offer a dividend, it might seem counterproductive to funnel cash to shareholders instead of:

- Paying their employees more

- Funneling money into research and development, refining what they offer

- Using the money to offer more employee benefits

- All of the above??

Rest assured, companies that offer dividends often do so specifically to attract more investors, which is totally understandable. It just means that for you, the investor, you’ll want to take this into account while choosing where to park your hard-earned money.

Should You Rely on Dividend Stocks?

Dividend stocks mean you don’t strictly have to sell your stocks to get money from them. Sure, you have to deal with the taxes on them, but how different is that from the taxes you incur from selling growth stocks? That question is one for you to answer for your specific, unique situation and needs.

Fair warning I’d like to add here: measuring your returns on only dividends won’t make you a lot of money. At times I’ll hop onto dividend-focused blogs and take a look at what they report as their dividend returns. I’ve noticed not too many dividend bloggers will include how much they have invested in the same post where they talk about dividend returns. Getting $1,000 back on $3,000 invested is a phenomenal return of 33% (with 10% as your average base comparison). Getting $1,000 back on $300,000? Not so much with a return of 0.3%.

To illustrate, I wrapped up reading a 2021 dividend overview from another blogger I won’t name here. They have a total of $700,000 invested (specifically $700,688) as of the time of my reading. They classify themselves as a dividend investor and posted an income report for 2021. With that much money, they have received dividends for the year totaling $21,266.

That’s a great chunk of change, until you do the math and realize that’s a 3% return. Inflation in 2021 was 6%, or double that.

If they were doing the math on dividends alone, their return would have meant they lost money.

That’s clearly not the case when you count how much more valuable the stocks are now – the S&P 500 delivered a whopping 23% in 2021, to set another baseline. Dividends make up just one part of the overall return, so don’t focus on solely that as your measurement for success. But these dividend bloggers mainly focus on dividend return only, instead of the overall return. I don’t see much writing about how the stock’s growth supplements the returns.

The Best of Both Worlds?

In my investing strategy, I don’t need to worry over the merits of dividend stocks versus growth stocks. This is specifically because index fund investing makes the distinctions moot. An index tracking the entire stock market will, by definition, automatically include both dividend stocks and growth stocks in one convenient fund. The overall stock market includes dynamo winners, horrible losers, and a bunch of others that are eking out okay. I wouldn’t know which ones would reach negative growth and which ones see their value skyrocket, but because I invest in all of them I end up reaping some sweet, double-digit-historical-average returns.

Don’t get me wrong, it’s really damn nice to see dividend cash come in. When I planned to make $10k in side income in 2021, I figured I’d make at least $1,500 in dividends that year. Turns out, I made $500 more than that. A better example might be in Purple from A Purple Life, who I’ve written about before. She is 100% invested in index funds tracking the stock market. Her dividends are now steadily breaking $2,000 each quarter; that was enough to cover half of her expenses each year. And she never even cared about getting dividends!

They’re just a nice byproduct!

Is it nice to get dividends? Absolutely. Am I basing my investment strategy specifically around them? No. Once I rely on my investments to pay for my lifestyle, I’ll set up my accounts so dividends will go to my checking account instead of getting reinvested. Until then, it’s going to remain an inconsequential measure of my net worth growth. So, yeah. I’m very much biased in favor of index funds over stock picking. But I’m also in favor of giving you all the facts you need to make an informed investing decision. So, do with this writeup what you will.

Cover image credit: Alexander Schimmeck via Unsplash