My 2020, Acknowledging I’m No King of Finance

…but I still somehow rocked it anyway?

Who would’ve expected a pandemic to smack the world flat on its ass? I definitely didn’t when I started this blog last January. But hey, the world never claimed to be predictable. And that goes doubly for how finances shake out.

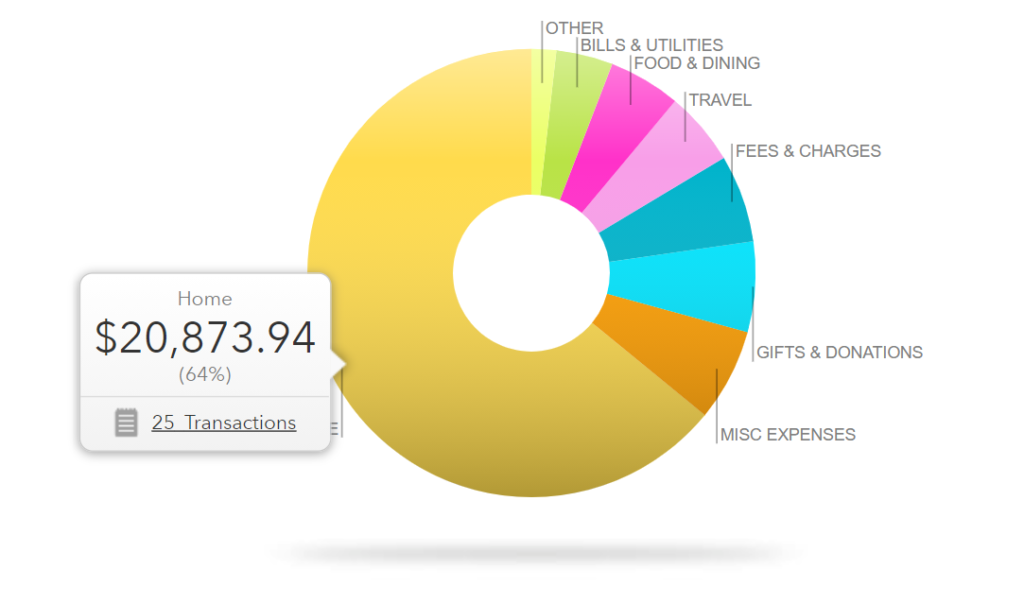

My 2020 Spending

I spent a LOT more on snacks, restaurants, and giving. Since I took zero crazy vacations and commuter passes, it all ended up balancing out.

Did I freak out over every last red cent I had, terrified someone would yoink them away if I wasn’t on guard??

No. Not at all. I don’t have a set budget for things like clothes, restaurants, toys, outings, or anything else. All of that falls under my “miscellaneous” bucket. If there’s something particularly expensive it went into the “overflow” bucket – in 2020 this included donations, (socially distanced) vacations, and charitable donations.

Speaking of donations, those ended up as my biggest change since 2019. I spent roughly $2,950 in this category. That was more than my 2.5% goal but hey, if there’s any one category I don’t mind going overboard on it’s that one. Especially in that year I’m eager to put behind us.

If you don’t include how much I spent on charity my overall yearly spend came out to $27,771. Even with spending like crazy with my brother currently visiting.

And the total amount of money I had spent in 2020, including donations, is:

$30,722.32

Not bad at all! Especially considering how rent alone was $20,400 of that. While I did go over my $30k budget goal, that overage is perfectly fine. Plus, my stimulus check from April more than covers that $800 difference so hey.

The Details

Unsurprisingly, my rent (and some utilities) took the lion’s share of my spending. Some of my utilities fell into other categories because I’m not that disciplined with organizing my expenses 😅. Rest assured though that everything is accounted for somewhere!

My 2020 grocery bill squeaked in at a little under $1,700 for the entire year, or $141 per month. If I was still going to the office this would be much lower as they offer(ed) free lunch and snacks. Since I’m positive we’re still in for several more pandemic months I’ve upped my 2021 grocery budget to $150 per month. We’ll see if that’s fine or if I need to up it later on.

I fully expect/hope my travel spending will go up – in 2020 that came out to $1,700 and was mostly thanks to New Year’s visits from my brother (both in January and the end of December) and a socially-distanced trip I took in June. There were so many trips I had to cancel last year, including jaunts to Seattle and three (!) California trips. While I did manage to do COVID-safe day trips to New Hampshire and Maine, I’m very much planning on more travel once it’s safe enough to do so.

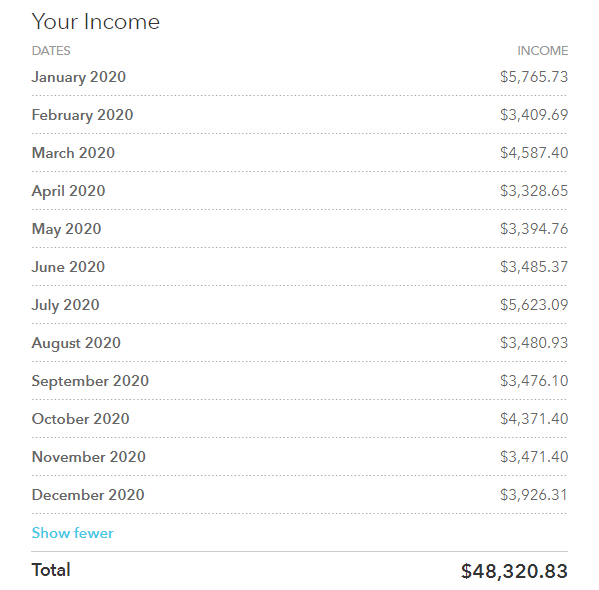

My 2020 Income

My post-tax income came out to over $48,000. If you include my 401(k) and HSA contributions on top of that, I ended up “bringing in” over $23,000 extra, for a total of $71,371.

Looking at the data Mint gives me, I’m seeing that I’ve now got a few solid income streams now besides my base salary. In addition to my biweekly paychecks I’ve received extra money from a bonus check in March, monthly interest income on my savings accounts, and bank account bonuses. I plan to discuss the bonuses in a future post, but I’ve started earning them by taking advantage of bank account offers. Anything extra definitely doesn’t hurt 😉

So despite 2020 being 2020, it was actually a great year for me income-wise. With the caveat, of course, that I remained employed. I happened to land a great, cushy job about six months before the pandemic hit. If I was in either of my former roles I’m positive I’d have been furloughed or outright laid off. That was a massively lucky move I had made when I had no idea I’d need the job security a healthcare company would provide. 2020 has really proven the quote “luck is what happens when opportunity meets preparation”.

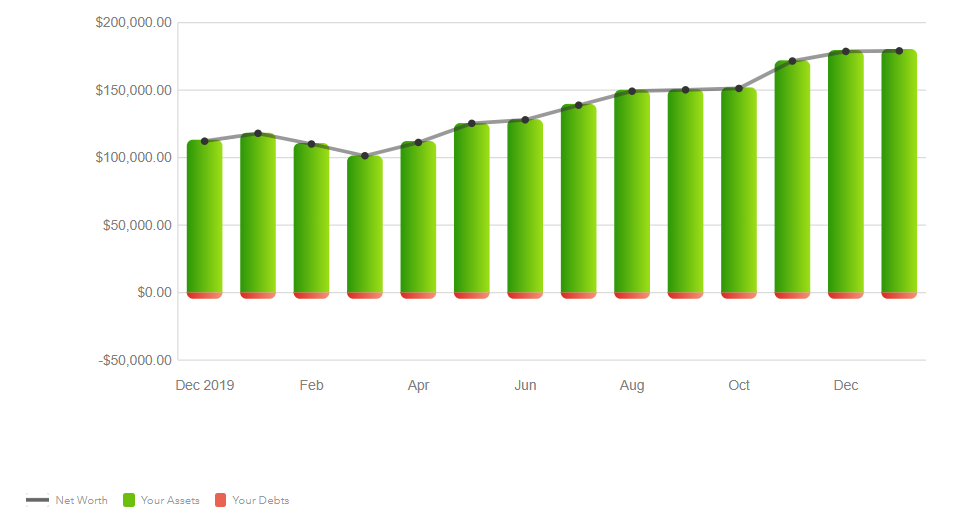

My 2020 Investments

On New Years 2020 my net worth was roughly $115,000. New Years 2021 showed that number had grown to about $186,000.

SO NO BIG DEAL.

EXCEPT IT IS.

Thanks to investing in index funds I managed to grow my wealth by almost exactly how much money I earned post-tax this year. A seventy-thousand-dollar difference really feels like funny money to me. No one I grew up with is really seeing that kind of crazy growth, especially in that CRAZY YEAR.

This huge growth was the greatest surprise. It really goes to show you how divorced the stock market can be from the overall economy. The stock market doesn’t include small businesses like your locally-owned restaurants and shops, which have been struggling hard thanks to our 21st century plague and poor response to it. That’s an important note as I’m not feeling as pleased about how much more money I have now; it’s a hollow sort of victory when so many millions are hurting.

Here’s To a Better Year

I’m clearly doing nicely and can continue what I’m doing, which is working from home and making few, if any, trips outside my front door. For several others, this is definitely not the case. I want this to be a better year so we can all have a better year. Because, well, this sucks. For everyone. There are those like me who can weather it just fine, what with the whole luck factor we’ve grabbed onto. I can’t get over how my comfort has really boiled down to sheer luck of the draw; guaranteed I’d be in much worse mental health if I was still sharing an attic apartment or still living around my hometown.

There are countless others who are currently where I was three years ago, and I know from experience and empathy it’s not a fun place to be. I’m hoping to strike a balance between feeling proud/relieved about my good financial year while staying in touch with common reality. Which is to say, keeping humble. The only reason I came out of 2020 (relatively) unscathed is thanks to the job advice and financial education blogs like this one provided. Ain’t no way I’m taking that for granted. Not when it’s become my ticket to peace in a time of utter chaos.

Cover image: Kevin Oetiker via Unsplash

First time commenting on your blog, but a big fan of your writing 🙂 Congrats on your amazing net worth growth!

Like you, I was lucky enough to keep my job and continue investing in the market this year which led to a nice net worth increase as well. I completely relate with feeling guilty enjoying a great market return this year when so many others are struggling.

Happy New Year and here’s to hoping for a great 2021 for everyone!

Thanks so much, and hats off to you for the same Avery!

Hey

Preparation meets opportunity. It’s so great you had made the job transition. There is no foresight in predicting a pandemic.

My family was also blessed with the same Fortune. My husband moved to a new company in Nov 2019, and just told me yesterday that his previous company is already on round 4 of lay offs. People can volunteer. But that in itself is only an opportunity if you are financial stable.

We haven’t traveled at all. Still not sure how people do it w/o using public bathroom… So hope next year is better

Agree on all of this, especially your last point. 💚

Good article. I’m very lucky to have a job with a the city. And I’m still able too contribute to my IRA and 457 plan. As far as traveling I’ve been too Mexico and got a chance too stay right on the beach. Life’s too short not too step outside and enjoy it. Stay safe.