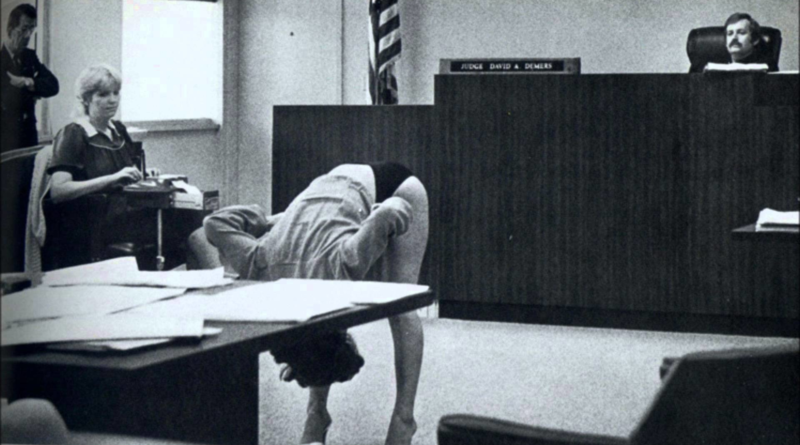

Tax Deductions, My Salary, and Pulling My Pants Down for the World to See

We’ve discussed how talking finance is even more intimate than sex. Now that I’m going to publish my salary and expense information, this is the equivalent to uploading a naughty video. So hello all, here is my financial underwear.

My salary is around $90,000 a year, including my annual bonus and any incidental earnings. More than three quarters of that ends up in my financial accounts, and the rest – including taxes owed and all of my expenses – are what I consider gone with the wind.

Tax Deductions, Taxes, Everything TAXXX

Pre-tax deductions are an essential piece to this. These deductions cover the part of my salary that is NOT taxed, which is possible thanks to Congress okaying it. I didn’t have access to deductions in my previous jobs so I’m excited to optimize my tax burden with it now.

I plan to contribute the full amount allowed to my 401k, which is a retirement investing account for funding your expenses in your old age. This is the most well-known deduction option that, for this year, is capped at $19,500. Since my savings are going to retirement anyway, I’ll happily take full advantage.

All of a sudden that makes my salary, in the eyes of the IRS, dramatically lower (as in, almost 25% lower!) According to the government, for tax purposes I now have a salary of $70,500 instead of $90,000.

But we’re not done yet!

I’m also contributing the full amount to my Health Savings Account, another investment account designed for medical expenses. Only certain health plans give you this option, and thankfully my employer-sponsored health plan is one of those. That’s an additional $3,550 that’s deducted from the bottom line, bringing it down to $66,950.

The final deductions come via the amount I need to pay into said health plan, which is a very reasonable $20 per paycheck (rounded up). Over 26 pay periods that makes for another $520 I pay to ensure the bare minimum health care, including vision and dental. This final deduction makes my total taxable salary $66,430!

Now we’ve reached the point between “pre-tax” and “post-tax,” to that dreaded three-letter word that makes billionaires cry on TV. This is taken as a percentage of my income instead of a flat fee.

Thanks to my pre-tax deductions, this comes out to a lower amount than it would have if I didn’t take those. In my calculations I use 25% as the measuring stick of how many taxes I’ll likely pay, which makes any future refunds I might get a pleasant surprise*. So! Taking 25% out for taxes that leaves me with a grand total of $46,822.50 total to live off of!

I’m actually a little new to this as I only took this job last summer; my former job paid a little over $70,000 with no pre-tax deductions available. So the first half of 2019 was at the old job before I bounced over to New Job. The only spending difference New Job required was taking public transport to work instead of my previous walking MO. I have the option to pay for my transit pass with pre-tax monies, which I did take advantage of in 2019.

Local Lady Declines Extra Cash Proposition, Leaving Everyone Confused

Now, I’m in my mid-twenties with really no obligations (mortgage, children, pets, serious medical conditions, whatever) and can live very nicely on less than that. In 2019 my expenses didn’t exceed $30k. If I still can’t spend more than that in 2020, I will have a little less than $17k to invest outside of my 401k.

$6k will go into an Individual Retirement Account (IRA), another type of retirement investing account that any American can contribute to. With $6k being the maximum amount I can put in, I will then have 10 or 11k to put into my taxable account! That amount gets me almost three quarters of the way to a down payment for a 400k home, assuming I qualify for an FHA loan. This can also pay for a semester of college tuition** or a kick-ass international vacation. In short, I got options. A whole slew of ‘em!

Which is… really weird, if I think about it for too long. I grew up in an economically-depressed county with a lot of crime and not much to do, except screw around online or watch corn grow. Financial stability is a pipe dream for the majority of people in my hometown. I know how unusual my position is, and that’s influenced my need to keep costs at least a little modest.

Those costs, excluding my Boston-area rent, came out last year to $9,600 total.

Yep, that was a pretty cool feat. And that includes paying for vacation Airbnbs, car rentals, restaurant dinners, AND my grocery bills! It goes to show that being in a high-cost-of-living (HCOL) area of the country doesn’t mean you need to pay top dollar for everything.

Bad news is, it means you DO pay top dollar for housing; my rent alone is $1,700 a month for a two-bedroom apartment, not including electric or gas utilities. Folks from more rural areas are balking at that number, and people from NYC or California are likely going “That’s so cheap!!” To be fair, people around Boston are pretty impressed by that number too. To give some perspective, a good friend of mine lives in downtown Boston, where she pays $3,300 for her one-bedroom abode. Whew.

(FYI: The average cost for one- and two-bed apartments in Boston are $1,700 and $2,100, respectively. Anyone that knows the market knows how much of a screaming deal I got, especially with such a nice place and neighborhood.)

So! Adding the $20,400 I spent on rent brings my official expense number to $30,000. If I ever need more to live off of I actually have that option, which was not a choice when I started that receptionist role in 2016. That’s right: I only spent 33% of my salary last year! On my old salary this was closer to 43%, so it’s a phenomenal improvement.

“Duh, Darcy,” the naysayer says. “We get it, you’ve done that. But HOW did you ACTUALLY spend that much?”

Through a lot of hard questions to myself, lifestyle tweaks, and thinking about every purchase. Which, again, is hard to do. I’ll break down my spending in the next post to give you an idea of how it’s done.

Is there anything else I can answer about my financial situation? Let me know by leaving a comment, and I’ll reply soon.

*I should note here that, thanks to marginal tax rates, the percentage of my income that goes to state and federal taxes is more like 22% overall.

**This, unfortunately, depends on several factors, including that this tuition goes to a public college on behalf of that state’s resident. I went to a private university and will share the numbers from that in another future post.

Pingback:My $10,000 New Year's Resolution - We Want Guac

Why do you live in a 2-bedroom apartment? Wouldn’t it be cheaper to live in a studio or a 1-bedroom?

Hi Anna! It would definitely be cheaper to live in a studio/1 bed or with at least one roommate. I wrote another article on why I chose a two bedroom that boils down to: having a bigger place was still in my budget, made me happy, and was more important to me than the savings.