What Budgeting Tools Are Out There?

Yes, budgeting used to be hard. But thanks to stellar software advances in the finance space, there’s now several great budgeting tools to choose from to help you track your spending, investment performance, and everything else personal finance-related. I took a look at some of the most popular options and came down to five or so for your consideration. Each budgeting tools entry summarizes what its capabilities are and how it makes money; none of them do so by selling your data, which is one of my top priorities.

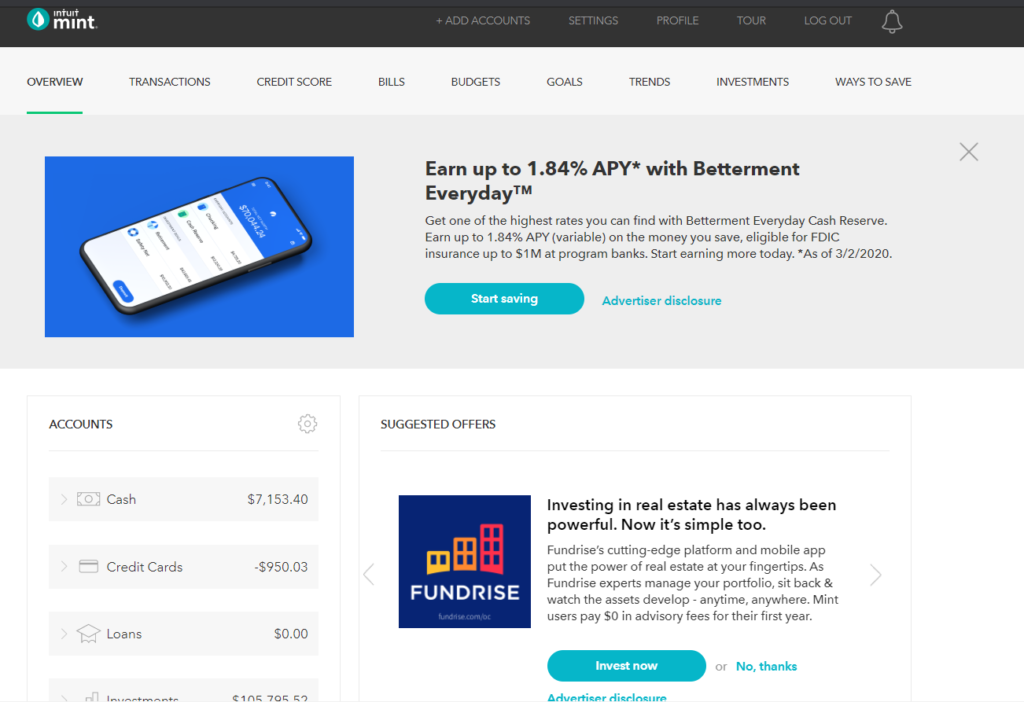

Mint

First up is the budgeting tool Mint I’ve used for years, which is an Intuit company with a free account. They make their money by acting as an affiliate for several other financial services (think credit card offers and investment software). Sometimes they send you emails with offers, but mostly these affiliate ads appear next to your data.

How Mint Works:

Once you create your free account you can add all of your bank accounts, investment accounts, credit cards, loans, and even your home and car equity. Once these are added Mint keeps track of your overall net worth and any transactions that flow in and out. You can input your budgeting parameters for the categories offered, or create your own if you don’t see what you want. The default setting for budgets is to budget it monthly, but you can work around that should you wish. Besides tracking your expenses Mint also provides other services like checking your credit score, graphing out your spending/net worth data, and tracking your investment performance.

Pros:

Between Mint and Personal Capital, I prefer Mint’s layout and organization. You can access Mint either in your browser or via their app, both of which are really convenient and make it easy to view whatever data you want. I also like that they don’t try to upsell me on other services beyond the ads placed throughout the app and site.

Cons:

Since it’s a free service they get a pass for some of the more annoying bits about Mint. Mostly it’s little issues that I only notice because I use it so often: tech support is slow to respond (or just completely unresponsive) if I need to make a ticket. The investment tracking tools don’t really work most of the time, so you have to log into your actual brokerages to see that proper. The app also takes forever to update your information if you’re the type of person who (like me) likes to check it daily. Nothing that’s a deal-breaker, just small annoyances that prevent it from being the ideal.

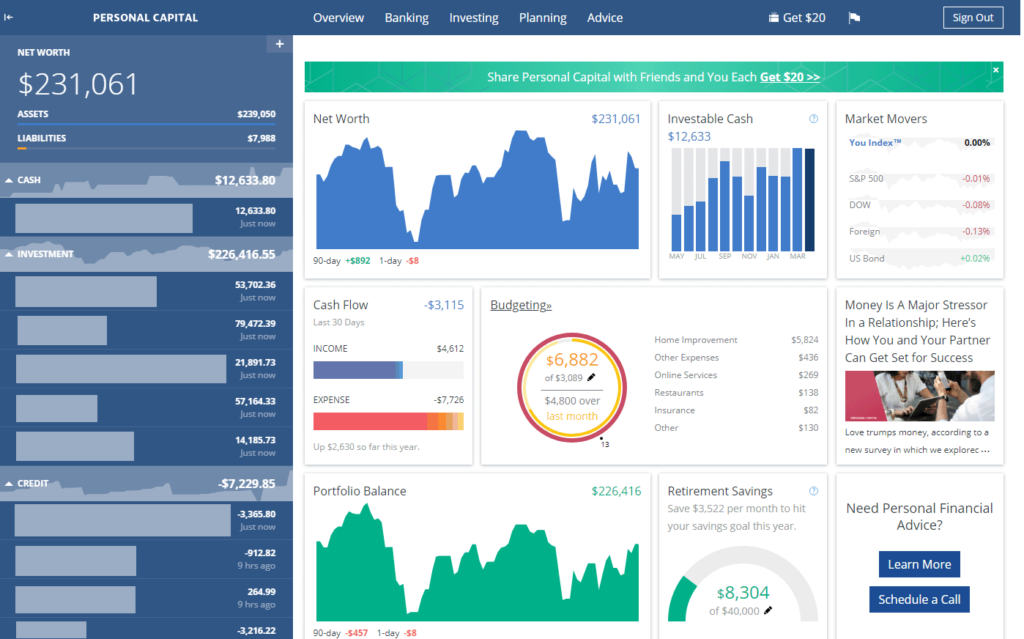

Personal Capital

Next is the other preferred finance software Personal Capital, which like Mint is also free. Personal Capital has a lot of similarities with the former, but its focus on investments and income make it very distinguishable from the competition. PC makes their money by upselling a financial advisor service to those that use the software; essentially, the free service acts as their lead generator. It’s not necessary to pay for Personal Capital, but I’ve heard they’ll call and email you several times to upgrade your service.

How Personal Capital Works:

Adding all of your financial account information, once you set up your account, is easy and breezy. Completing this step brings about a ton of analysis tools at your disposal, including sexy graphs and other visuals that go way beyond Mint’s more simple setup. Calculators, analyzers, cash flow comparisons and more abound, making it an awesome option for the very investment-minded.

Pros:

Because Personal Capital doesn’t rely on affiliates for their income, the software experience comes ad-free, which is such a rarified bonus nowadays. It also offers a lot more features with tracking your investments that Mint does not, again going back to less of a focus on budgeting in favor of wealth building.

Cons:

I hear through the grapevine that they call you pushing for paid services, which start picking up after you hit a six-figure net worth. And they don’t stop calling even when you tell them not to. I’m not thrilled with their outright ignoring these requests, it speaks of disorganization at best (which you don’t want in a company that has your financial passwords) and deliberate disregard for the end user at worst. Which tells me this: if you care so little about the person trusting you with this critical information, why would you care if said information was compromised? It’s mainly for this reason I don’t use them, despite all the great tools they offer.

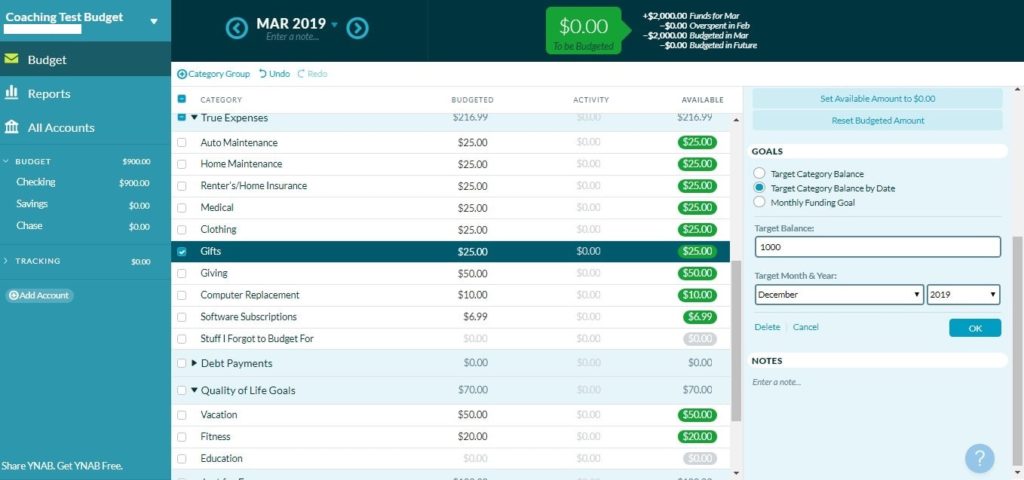

You Need a Budget

If you run in online financial circles, I’m sure you’ve seen the YNAB acronym somewhere. This stands for You Need a Budget, which is by far the best for folks who really struggle with putting together a budget and sticking to it. YNAB makes their money as a paid service – unlike Mint and Personal Capital, you need to pay a monthly fee to use YNAB’s software.

How You Need a Budget Works:

Once YNAB knows how much money you’re bringing in, it makes you budget every single dollar of that into something. It’s got very detailed budgeting features to keep you on track with your spending, which you can access via their app or on any desktop.

Pros:

It’s tight and efficient with what you give to it, and there’s countless testimonials that rave over how it’s completely turned people’s lives around. Some might not like that it has much less focus on investments, but I consider that a pro for those that need it. If you’re so new to budgeting tools that your spending outweighs your income, you’re not yet at the point of investing anyway.

Cons:

Really only the sticker price. As of this writing that price is $11.99 a month, or $84 for a whole year. In the long run, however, it’s a small price to pay for bigger gains and actually getting your spending under control.

CountAbout

Out of everything on this list, CountAbout is the new kid on the budgeting block. This company used Quicken’s software as its inspiration to build out tools and features applicable for both personal and business use. If you work as a freelancer or have a side hustle this might be the best option for you, as CountAbout offers invoicing features as well to help you track everything coming in and out. CountAbout, like YNAB, makes their money as a paid service; this means no ads clogging your dashboard or salespeople calling you to push a service.

How CountAbout Works:

If you’ve ever used Quicken before you’ll find the process to be pretty familiar. After inputting your financial data you can view everything in an Excel-like format for ease of navigation on all debts and assets.

Pros:

I actually tested it out myself and it’s a neat approach to budgeting and keeping track of your net worth. The UX design felt familiar to use and, if you’ve used accounting software or Excel in the past, you’ll likely feel the same. If you want to try it out yourself you can follow the link here for a 15-day free trial.

Cons:

Same as YNAB with the sticker price, but it’s MUCH more affordable at $10 per year for the basic version. For perspective, you’re getting a years’ worth of software for less than a month of the other competitor’s. Budgeting tools like this are hard to find!

Microsoft Excel/Google Sheets

The OG manual option, your spreadsheet software makes up the most reliable of your available budgeting tools. Ultra-secure since it’s localized to your computer or Google, and the only way anyone else can view your data is through you (so stay vigilant!) If you know what you’re doing and don’t mind manually inputting the ever-changing financial data, using Excel or Google Sheets is for you. Even better, you’re either not paying for it at all (Google Sheets) or likely already have it installed (Excel).

How Excel and Google Sheets Work:

You get to play around with rows, columns, formatting, equations, and pivot tables to your heart’s content. There’s plenty of templates online from what others have created (I like the two here and here, both from Reddit) which you can use if you don’t want to build your own.

Pros:

Extremely customizable and flexible for anything and everything you want. As other bloggers point out, it also really forces you to take an active role in managing your finances.

Cons:

That active role means it’s much less convenient to view your financial standing. Instead of logging onto a website or app, you’ll have to log into every financial account you own and input that data into your spreadsheet. If you’re a lazy person or just not that diligent, this would leave you in bad straits; not want you want for your budgeting tools.

Conclusion

Each budgeting tool aligns well to different personalities, which I noticed while compiling this list. The hyper-organized and particular individuals will do best with their own spreadsheets, while accountants and business-minded people will gravitate towards CountAbout. The Spendy Sallies of the world will best appreciate You Need a Budget, or really anyone who struggles with sticking to budgets on their own. For the laid-back crowds that are more interested in general tools Mint is the way to go, while the crowds that are more interested in specialized wealth tools will go to Personal Capital.

If you’re still not sure which of these budgeting tools is the best for you, feel free to shop around. Both paid options offer free trials, and it won’t cost you anything to make a free account or file with the rest. And unlike Equifax, your data is much more secure here 😊

Is there anything more I should include on this list? Perhaps another budgeting tool I didn’t hear about before? Sound off in the comments below!