My 2023 Finances in Review

Now with more tables than ever before, I present to you: my 2023 finances in review!

2023 Spending

For reference, here is my yearly spending since 2017:

| Year | Spend |

| 2022 | $46,647 |

| 2021 | $43,442 |

| 2020 | $30,722 |

| 2019 | $29,999 |

| 2018 | $24,985 |

| 2017 | $13,280 |

With 2023 on the books, I can officially add a new line to that table:

Total spent in 2023: $45,968.95

Technically this number includes my January rent and security deposit after moving to Los Angeles. If we don’t include that amount, my spend was $42,368.95. That number is less than both 2022 and 2021, which I’m relieved to see. I really didn’t want to continue the trend of increased spending every year.

I am also proud to see that my total spending went down slightly in 2023 despite:

- Spending a month in Europe (this time going to Scotland, Hungary, Slovakia, the Czech Republic, Austria, Liechtenstein, and Switzerland!)

- Visiting Canada on two different road trips (Quebec City, Montreal, and Ottawa!)

- Moving across the country in December via road trip

The Berkshires in western MA has a lower COL than Boston; I shook things up in my budget by moving to the Berkshires for a couple months, which drastically lowered my spend on housing. My rent went from $1,700 a month to a much more palatable $900. Because I moved out, my landlord also gave my security deposit back ($1,700) which helped when it came time to pay for my December Airbnb in Los Angeles while I apartment hunted. To give a better visual, here’s what I spent for housing each month:

| Month(s) | Spend |

| January-August | $1,700 |

| September | $0* |

| October | $900 (avg with Nov) |

| November | $900 (avg with Oct) |

| December | $2,267 (CA Airbnb) |

My usual rent payments have me at $20,400. This year, I paid a total of $17,667. Love seeing that go down too for once!

Savings

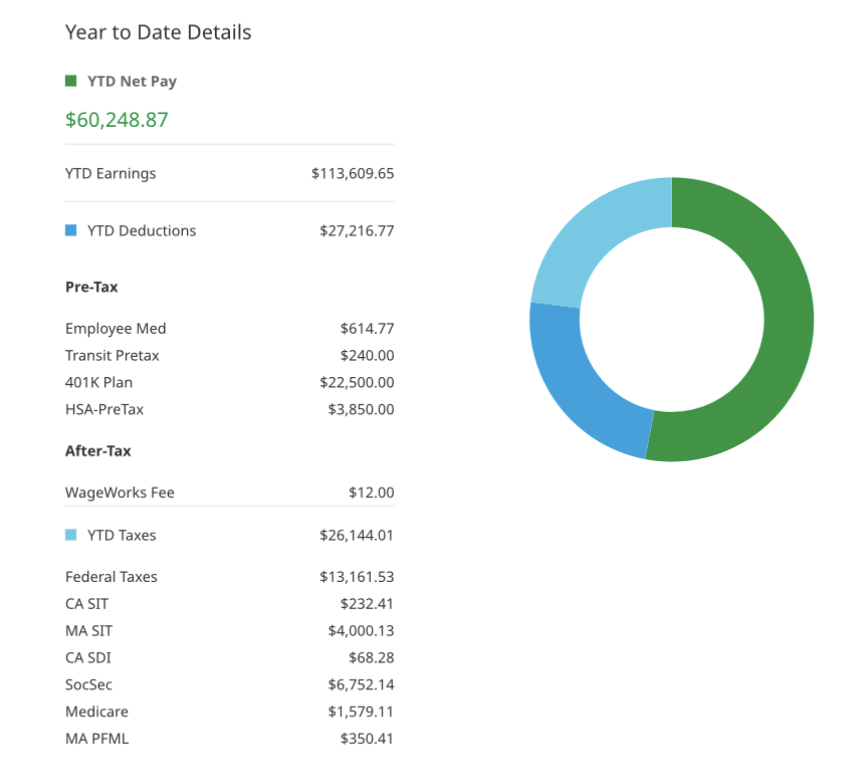

This now marks the 3rd year in a row that I have made over $100,000. My pre-tax income comes in at $113k, which is $5k more than what I made in 2022. My net income also increased from to $60,248. Subtracting my total spend from this number left me with $14,279 in savings from net income alone.

If this article was an infomercial, right here would be the part I’d yell “BUT THAT’S NOT ALL!” I also maxed out all of my tax-advantaged investment accounts. This includes both my pre-tax 401(k) contributions as well as those for my Health Savings Account (HSA). For 2023, the respective limits were $22,500 and $3,850. Thanks to my employer’s 4% match, I can also add about $4,543 to my total coffers.

| Type | Amount |

| 401(k) contributions | $22,500 |

| 401(k) employer match | $4,543 |

| HSA contributions | $3,850 |

| Net savings | $14,279 |

| Total | $45,172 |

Percent of income saved

There are several ways to calculate this percentage and I thought it’d be fun to see how different these percentages are depending on how you interpret the data. Below is what I discovered!

| Net savings from net income (NI) | 24% |

| Plus pre-tax 401(k) and HSA contributions from these plus NI | 46% |

| All above, plus employer 401(k) match from these plus NI | 49.5% |

| All above (~$45k) from total pay ($113k) | 40% |

The above is counted without considering what I paid in taxes and health insurance.

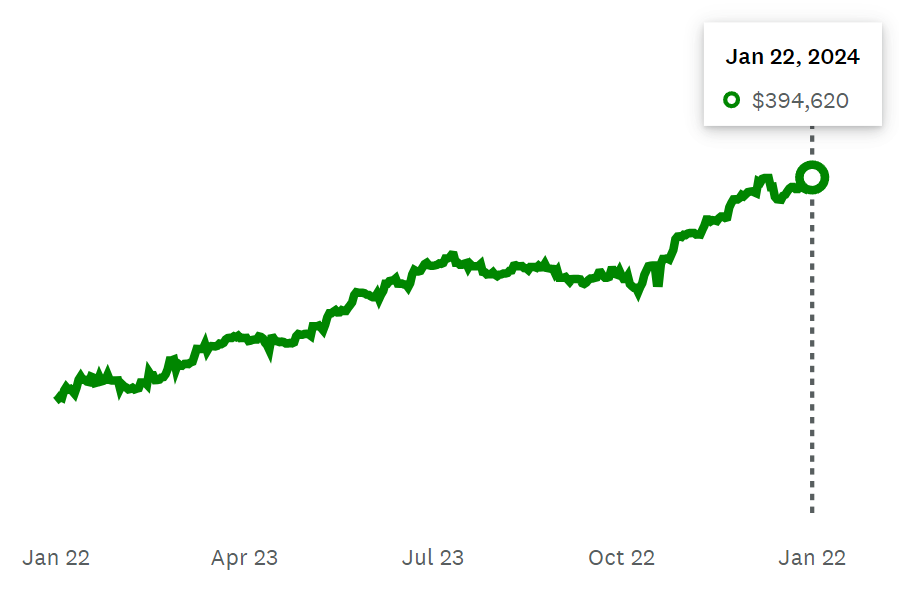

Net worth Change

This is the biggest change I’ve ever seen with a phenomenal growth of +120k. On New Years Day 2023 I had a $272k net worth. On New Years Day 2024, that net worth was $394k. On top of being within spitting distance to the $400k milestone (SO CLOSE) it also shows a bigger gain in one year than I have ever experienced. It sure makes up for the down year in 2022!

As the net worth change might have told you, 2023 has been wonderful for returns. Since I invest mostly in total stock market index funds, I saw a return reflecting that of the overall market: 25%.

Ally Bank has increased its savings account interest rates like mad in the last year, so I made out like a bandit with $183 paid to me. Since I invest in all the companies in the stock market, I also get dividends from the companies that pay those. In 2023 I received a little over $3,000 total from my taxable and Roth accounts. Nice!

My Personal 2023

As I mentioned in the 2022 review, I was formally diagnosed with a medical condition the Internet dubs as one of the most severe of its kind (thanks, Internet, way to put a positive spin on things). I still don’t want to talk about it or get into the specifics, but I’ll acknowledge that it still greatly affects my life whether I want it to or not (and it’s very much not). With that said, 2023 has been one interesting year as I navigated my new reality framework. I reached out to friends a lot more than ever. Went on a lot more road trips as my time in New England came to a close. And, most importantly, refined what I wanted out of life in the next few years.

This led to doing some major changes. Namely, moving to Los Angeles after living around Boston for 11 years. I’ve been nervous about this change since I first decided to do it in February (!) but so far it’s emphatically proven the correct decision to make.

Looking Ahead at 2024

Finance-wise, it’s going to be harder to track my finances the way I was used to. The software I used to use, Mint, is no longer with us (RIP). I’ve moved my account over to Mint’s successor Credit Karma, but there are a lot of features that didn’t make it over (F). At least some of my 2024 will be dedicated to figuring out a new process for giving me my full financial picture, so stay tuned for that.

In neutral news, the contribution limits for tax-advantaged accounts are all increasing! I’m aiming to max out my contributions for all of them so I’ll make sure to adjust for that.

| Account Type | 2023 limit | 2024 limit |

| 401(k) | $22,500 | $23,000 |

| HSA | $3,850 | $4,150 |

| Roth IRA | $6,500 | $7,000 |

| Difference from 2023 | $0 | $1,300 |

Around April I’ll get my 2023 bonus, which should be the biggest one ever thanks to bonus restructuring my company told us about last February. My base salary should also get a bump, which should finally push me over earning $100,000 without my bonus. YEEEEAAAHHHH!

And surprisingly, I predict my spending will stay about the same in 2024. My new rent in LA is $1,750 for a one-bed apartment, which is only $50 more than what I paid in rent in Boston. I originally thought my rent would look more like $2,000 a month, so that’s an extra $250 back I thought I wouldn’t have. Very good news for me!

There are a few things I know for a fact are taking place this year I’m VERY excited for.

- March: I plan to visit Arizona for 10 days to hang out with chosen family and visit the Grand Canyon!

- April: I’m flying back to Boston to attend my friend’s bachelorette party. That I am also planning from 3,000 miles away, because did I mention she picked me as the MAID OF HONOR. The distance is not daunting, for my joy knows no bounds.

- June: I’m flying back to Boston (again) for my friend’s WEDDING!!! I was there for her through college crushes, breakups, and Tinder mishaps. Her fiancé is a super cool dude and they are so good for each other. I can’t wait to see them get married at their dream venue!

That’s a wrap on 2023! May our 2024 be a joyous one!

Cover image credit: Yasin Hoşgör via Unsplash

Sounds like a great year! Now here’s hoping you cross the 500k mark sometime soon!

Keep it up. Your blog is always a joy to read

Thanks Jon! And yep, here’s to hoping !

Congratulations! Just March of last year your net worth was 300k, maybe by March you will reach 400k. And then 500k by March 2025. Let’s go!!!

It’s so crazy that you only contribute about 40-50k a yr and you net worth increase by 120k. Are you 100% in VTSAX? Do you diversify a small portion to a more risky investment?

Thanks Hannah! I am ridiculously close to crossing $400k and I’m a little mad it hasn’t happened yet. But I got paid this Friday and my 401(k) contributions hit on Tuesday, so I will be refreshing my accounts next week with a 🥺 look the whole time until I see that dang 4 as the leading number !

I also agree it’s crazy, like… what do you mean, my huge contributions only make up a third of the growth?! But it makes sense considering the rate of return. Getting 25% on a $300k portfolio equals a gain of $75k. Add my $45k saved on top of that and the math shows off the magic 🙂

I’m pretty much all in on VTSAX nowadays; the only other investments I’ve done in the last few years was buying some GameStop stock when that dominated investment news. Other than that I still have crypto I haven’t touched since 2018-ish. It’s around $12k now, so not really moving the needle much nowadays.

Thank you for posting the specifics. My EOY paycheck shows $75k gross and just under $40k net, so I’m feeling very good about that. I also maxed out my Roth and 401k in 2023, and bought a used EV and a house. I have not calculated my savings rate for 2023 because I do not want to, I am not used to seeing that much money leave my accounts at once, but the important thing is I stayed the course with the deductions. With this week’s run of all time highs (and continuing to max out my 401k each paycheck) I’ve just crossed the $150k net worth milestone, not counting any house equity because mortgage interest is crazy. Maxing my Roth this year is going to be harder because I have to replace the furnace and hot water heater with heat pumps so we can cap the gas line, but I’m determined, so it’ll have to be a no-spend year.

I graduated college one year before you, and sometimes I wonder where I’d be financially if I’d started working full time straight out of college like you did, but I treasure the experiences I had living abroad and I feel like I’m in a solid position now anyway, so no regrets.

Congrats on an exciting year! Killing it with maxing out those accounts, especially as a new homeowner. Plus, as someone who’s run the numbers a lot about this, $150k invested at 30ish years old will make you a millionaire before you hit retirement age. Any further money you invest will just make that reality come sooner and sooner. No need for the what-ifs, you’re doing great on that front!