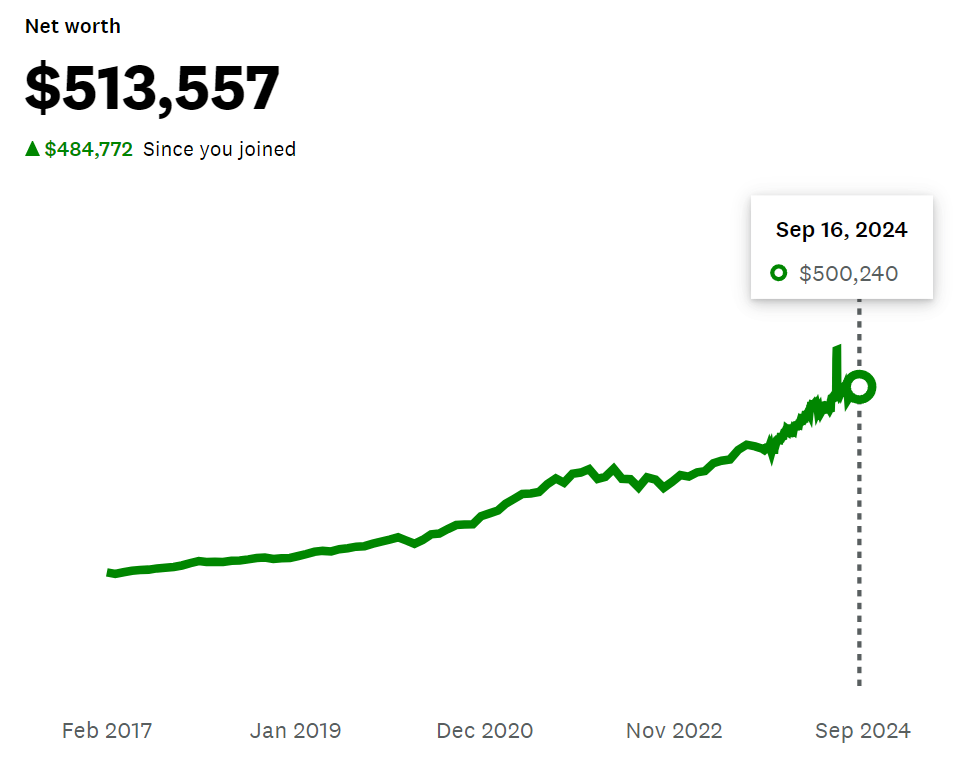

$500,000 Milestone Reached: Net Worth Update!

Since July I’ve been ridiculously close several times to hitting this $500,000 net worth milestone. Once, I was only $600 away before the markets fell back down. But here we have it: I’m sitting pretty at 30 years old with a half million dollar net worth!!!

This milestone comes with theme music! Cue the intro to Fergie’s “London Bridge”. 😉

With this I’ve managed to double my net worth in a little over three years’ time. I can now say “I’m worth half a mil” in truth. And I have for two weeks now, which feels fantastic. I’m really glad I have my blog as a reference to see what I wrote when I reached other milestones. It reminds me of when I was first playing around with data at my receptionist job and Networthify telling me I’ll reach a million dollars when I’m 45 years old. Today’s calculations tell me that can be at 35 if I add enough money each year, but I’m getting ahead of myself.

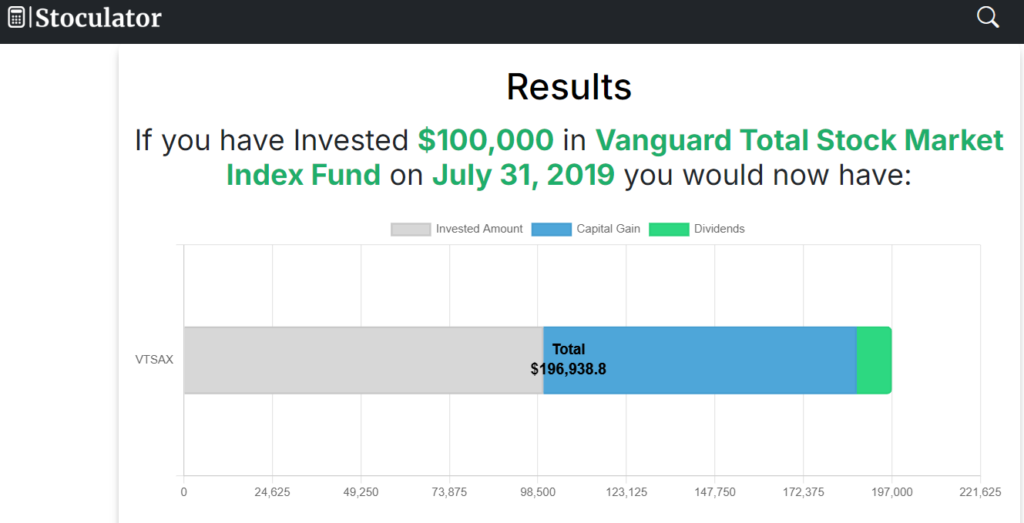

Remember my very first article ever on this site? I mentioned I hit my first $100,000 in July 2019. Had I left that fully invested and truly did not contribute anything else, I would have a hair under $200,000 today.

Instead, I kept following the tenets of the FIRE movement. I job hopped for higher salaries, kept costs lower than my take-home pay, and invested the difference in index funds. That has led me to now hitting this new high of a $500000 net worth, 2.5 times higher than what it would have been otherwise.

$500000 Net Worth Possibilities

In the last couple weeks, I can’t tell you how much googling I’ve done to see who has advice on what to do with $500000. The little consensus I’ve gleaned has been “use it to put yourself in a better financial position”. The two most common forms of advice on investing it narrow down to investing in the stock market, and investing in real estate.

Let’s look at the one I’m doing first: investing in the stock market, more specifically index funds. With a 7% yearly return on my investments, I will become a millionaire in 10 years (at 40 years old) without contributing another penny. With a 10% return, I will become a millionaire in 7 years. If I get a 10% return, and also contribute $30k each year, I will become a millionaire when I am 35 years old. These numbers don’t feel real to me yet, especially because the index fund strategy is very much the easiest strategy to wealth. If you’re like me and love seeing results with no extra work needed, this is the path for you.

As for real estate, the whole country (perhaps world) is your oyster. With a $500000 net worth, I have my choice of living basically anywhere in the country. Do I want to move to the Berkshires? Several large houses await. Do I want to move back to Boston, or just move to another place I own in LA? I have options for both of those, too! I’m seeing a few really nice condos up for sale online for that price point; that sure is a surprise to me, ha.

How a $500000 Net Worth is Enough to Retire

With half a mil, we’re officially in the range where it’s usually asked about in relation to retirement. Since the “RE” in FIRE stands for “retiring early,” this isn’t much of a jump in logic for me either. In a nutshell:

- With the 4% rule, I can withdraw $20,000 a year to live on or $1,666 a month. This is the equivalent of working full-time (40 hours) for $9.61 an hour; this is more than the minimum wage in 20 states. The part-time, or 20 hour, equivalent would be earning $19.23 an hour. What!

- On a monthly basis, that $1,666 covers almost all of my Los Angeles rent (said one-bed rent being $1,750). Should I move into a new apartment with a roommate here, I could have my housing completely covered. By moving to a slightly less costly city, I could still live alone while having all of my housing costs taken care of.

- Speaking of moving: The Earth Awaits estimates that, should I stick to a very lean budget, I can have 100% of my expenses covered in several Florida cities, Grand Rapids, Minneapolis, Boise, Tucson, and/or Milwaukee. I’m most excited to see that this list includes Albany NY, which estimates a “very lean” budget of $1,621 will cover all of my living expenses. RentCafe notes that the cost of living in Albany is only a little above the national average at 3%; not only does this mean I could settle down in an area I’m already familiar with and enjoy, but that I can do so in any area with an “average” COL.

Digging further:

Remember the $400k milestone from this post? The one that says you can move to the Mediterranean? Well, at $500k I can now simply live in a different LCOL (low cost-of-living) city every month or every few months and live a life of leisure 😲 I can choose world-class cities like Budapest and Prague. Or read books on beaches in Sicily and Greece. Alternatively, hop around several South American cities in Argentina, Costa Rica, and Mexico.

OR, I can simply settle down anywhere with a low cost-of-living in the US. This includes the Berkshires as I noted in my leanFI assessment, along with several other rural-to-suburban areas. The Earth Awaits notes that there are a few urban areas with a low enough COL to work for me like Little Rock, Arkansas and Lexington, KY.

Should I choose to retire from the traditional workforce, I could still easily afford living in more mid-COL areas by working the bare minimum. Let’s do a thought experiment here. Say I earn $500 a month after taxes in some quiet job. Using the 4% rule for the $500k, which comes out to a monthly withdrawal rate of $1,666 a month, an extra $500 on top of that would put me almost to $2,200 a month available to spend.

That’s a really nice thought for me, that I have enough now to treat full-time work as optional. The downside of this? It’s not very good for maintaining my career motivation. It’s very weird; I no longer have this anxiety that one wrong move could cost me my job, but without that anxiety I just don’t care about networking or otherwise making a good impression. My work still gets done in a reasonable enough time frame, just at a slower pace than what it used to.

Finally:

$500000 Net Worth in Fun Spending Terms

- If I spend $40,000 a year, I can currently cover the next 12.5 years without earning a dime

- A 20% downpayment on a $2.5 million house, or – as noted above – anything from a condo to a mansion throughout the urban and rural United States

- 250 vacations costing $2k each. Per week, that comes out to almost 5 years’ worth of vacations!

- A state-of-the-art electric sports car. Seriously: the 2024 Rolls Royce Spectre costs this much after customizations!

- $50,000 in growth every year, on average, with index funds

- 500,000 trees planted with the National Forest Foundation or #teamtrees

- All the college fees for 13 students for one year

- All the adoption fees for 192 foster children

- My closest Chipotle offers chips and guac for $4.90, for some ungodly reason. Half a mil nets me over 102,000 orders, which means I can eat one a day for the next 279 years.

Here’s to the next net worth milestone!!!

Cover image credit: Allef Vinicius via Unsplash

Crushing it. Well done!

Thanks so much friend!

Comgratulations! Half a mill is such a great milestone. You’re in the “boring middle”. The fact that you don’t feel as anxious at work is a good thing! Congrats again

Thank you!! That’s a good reminder about work haha, it’s just been an imposter-syndrome worry for so long that it’s an adjustment to work without it 🫠 And I know it’s called “the boring middle” but it sure ain’t boring to me !

Congratulations! 500k at 30 is $2M at 50 in term of today’s money. A nice, early retirement for you is guaranteed! At what net worth are you going to retire?

You know what, I think you just might be the first person who’s asked me that. My answer would be long enough to be its own article, but in short? My retirement date will be more about when I no longer want to work or I’m unable to, instead of about my net worth. Since I can happily live on my net worth right now, I’d retire right now if that’s what I most wanted. It’s just that I’ve got other things I want to prioritize first 🙂