Wait, I Just Hit LeanFI?: How to Calculate Your LeanFI Number

Earlier this year, I was checking out how much renting a one-bed in the Berkshires would cost me each month. It sure was something to compare the low-end prices there ($650 a month) and the low-end prices I found in Los Angeles ($1,750 a month). Out of curiosity, I used that to see how much my portfolio needs in order for me to afford rent, groceries, and miscellaneous bills. In other words, leanFI, or: to survive indefinitely (albeit cheaply) without needing to work again.

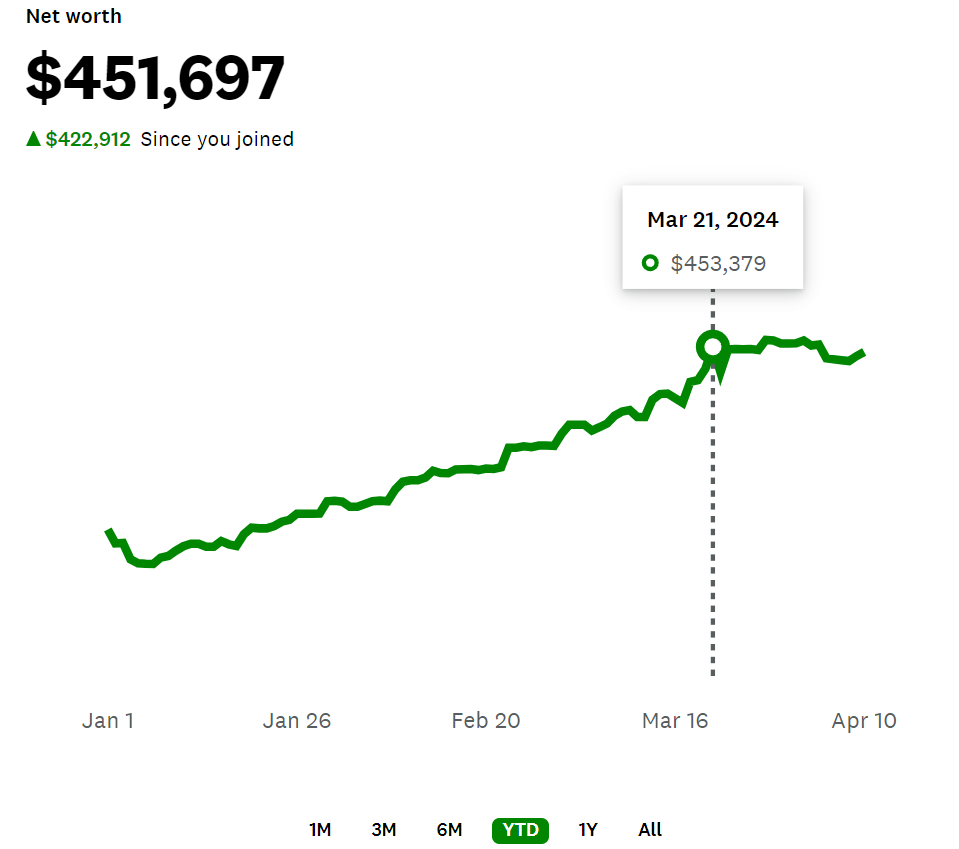

Adding it all together brought me to a survival budget of $1,425 per month. Multiplying that for 12 months in the year, and assuming I withdraw a “safe” 3.8% from my investments, leaves me to calculate a leanFI goal of $450k.

Which I hit last month.

Cue the shocked gasps from the studio audience!

I’m still years away from reaching full financial independence (FI). To me, that means having enough invested to cover all of my expenses to live. Being FI is different from being leanFI. The latter means having enough invested to cover all of my expenses to survive.

This is where the “lean” in “leanFI” comes from. In most places in the US you won’t be living a cushy lifestyle on this amount. It’s enough to meet your needs to survive, including food and safe shelter. To be fully FI would require more budget items for, say, entertainment bundles or mid-end shopping.

Assuming I move somewhere with a low cost of living (hello, geographic arbitrage) and spend only on the bare necessities, I would only need about $17,000 per year to do so. LeanFI is no glamorous lifestyle, but it does make for a fantastic milestone. And for me, it’s very nice to know I can say “bye!” to work whenever I please. Every further dollar I invest is there to pad my future, since the basics are officially covered.

How to Calculate Your LeanFI Number

This number will be different for everyone, depending on your unique life circumstances. Just like the full FI number! Factors like your number of dependents and your medical needs will impact how you calculate your leanFI number.

For me, I thought about the absolute basics of what I need: food, water, and shelter. When I’m paying for these things, that translates to groceries, utilities, and rent. To stay connected with others and have access to emergency services, I’d also need to keep my phone bill. Besides that, I’ll also have a running line item for surprise bills or expenses I might incur.

Thus, my leanFI budget covers just five line items:

- Rent

- Groceries

- Utilities

- Phone

- Transit/misc

Now comes determining the amount of money each line item will run me if I’m staying lean. Two resources help me out in determining this.

The first is researching costs. For example, I looked at rental sites like Trulia, Zillow, and Airbnb to see what the going rates are for rentals in rural areas I’m familiar with.

The second is my own records on my spending habits. My monthly grocery bills especially show me where I can cut things out (like my fancy $7 salads from Trader Joe’s) and what I can reasonably keep buying (bulk frozen fruits and veggies, pasta, beans, etc).

Thanks to these insights, I was able to calculate my leanFI budget:

| Rent | $650 |

| Groceries | $250 |

| Utilities | $200 |

| Phone | $25 |

| Transit/misc | $300 |

| Monthly Total | $1,425 |

| Yearly Total | $17,100 |

The rent would be either for a room in a city or for a one bed apartment in a rural area. I used upstate New York and western MA to arrive at that $650 number; it’s on the low end for rentals in these areas, but still gives me multiple options for that price. Groceries are also on the low end; I’m basing that on both my grocery history and estimates from The Earth Awaits on similar budgets. With Visible my phone service is still at $25, so no change needed there. And the transit/misc. would be its own category because I wouldn’t be doing much traveling on this budget unless I was walking or something unavoidable (think: driving to a grocery store if there isn’t a closer one).

If I want to spend more money, I’ll have to make more income or wait until my portfolio grows enough to cover more. Every $8k or so extra (specifically, $7,895) added to that leanFI number will allow me another $25 a month to spend. One excellent day on the stock market can boost me to a safe monthly spend of $1,450 a month. Once my portfolio grows another $25k, I can safely spend $1,500 a month. And it will keep going from there!

The final piece to calculate my leanFI number is my confidence in sticking to the budget. I already know I like living in the Berkshires thanks to living there for two months last year. I like living in winter too, seasonal depression be damned. Best of all, I’ll have a lot of fun FREE things to do in the area like certain museums, historical centers, and fantastic hiking trails. Woo!

Where Your LeanFI Number Goes Further

Remember when I mentioned geographic arbitrage earlier? No worries if you didn’t, because I’m going in depth on that here.

As a quick refresher, geographic arbitrage is when you move to a place with a lower cost of living so your money stretches further. When I first looked at the concept in 2020, I used housing costs as an example. A teeny tiny condo in the heart of Boston has the equivalent cost of a four-bed Victorian home an hour away in Manchester, NH.

Comparing costs across different areas in the US like this makes for some dramatic cost differentials. And, if you take that a step further and look outside the US, the costs can continue lowering ever further.

Once you’re able to calculate your leanFI number, I’d invite you to plug it into the site The Earth Awaits. It’s a nifty tool that keeps track of living costs all over the world and tells you how much you’d need each month to live in different places globally. It offers you options so you can filter the results according to your preferences. My preferences include:

- Cities in the Americas or Europe

- Renting a one-bed, outside the city center

- Family size of 1 (just me)

- A “modest” lifestyle (options here range from “very lean” to “opulent”)

You can further filter by crime rates, pollution rates, and things like freedom scores and gender equality in the advanced filters. Doing all of this spits out several places around the world I can happily live an average/modest lifestyle. Here’s a handful of those cities I could live in comfortably, right now:

The LeanFI Possibilities Abroad:

| City | Monthly Cost (via) |

| Buenos Aires, Argentina | $839.06 |

| Patras, Greece | $1,254.65 |

| Sevilla, Spain | $1,302.06 |

| San Jose, Costa Rica | $1,374.46 |

| Catania in Sicily, Italy | $1,381.68 |

I would LOVE any of these options, and there are even more besides. If I choose a more leaner lifestyle I can also live in some world-class cities like Tokyo, Venice, and Athens.

I’m already fine with living “simple”. The “lean” budgets that The Earth Awaits specifies are actually very doable for me. My living expenses Boston and Los Angeles are right on par with what The Earth Awaits considers as “lean” budgets. Thanks to this, I have confidence I’ll also happily fit the “lean” budgets elsewhere and not feel too much grief dropping down to a “very lean” budget.

Living LeanFI would be very different from my current lifestyle of living in the most expensive areas in America while also going on trips overseas. But I’m also confident in my abilities to adapt. Up until a few months ago I’d go on weekend road trips and sleep on a foldup mattress in my car at night. If I can happily do that and forego the creature comforts of hotels, I can let go of a lot of other stuff too if necessary.

Remember: LeanFI Isn’t Supposed to be Comfortable

If you’re different, that’s more than okay! All it means is you should keep that in mind when calculating your leanFI number. Only spending enough to survive isn’t meant to be comfortable, anyway. It’s only meant to keep you alive.

I actually spent less than my leanFI budget in 2017 thanks to being terrified of spending anything; should I make my return to a lean-n-mean lifestyle, I’ll do it without the overwhelming terror from those maigre days. That’s what’s important to me when I look at my financial progress since college graduation. I may not always be comfortable in the future, but I have tangible assurance I’ll survive whatever blows come my way. What a gift reaching leanFI makes, in that regard. 🙂

Cover image credit: Jeremy Bishop via Unsplash

Way to go Darcy! It gives a piece of mind knowing that you have your basic needs covered for sure. I am on my own journey, but with 2 kids will be a bit longer. All the the best 👌

Thanks friend! I took a look at your latest numbers and you’re killing it too. Here’s to both of us!

Congratulations on the big milestone!!!! That is fantastic! I can’t wait to watch you reach your next one!

Thanks so much Sam!! Hope you’re having a great spring ☺️

Are health insurance premiums & expenses factored into LeanFire’s expense calculation? If not, why not?

Hi anon – I didn’t specify, but there are a few reasons why insurance premiums don’t have a category of their own in my personal leanFI budget. The biggest reason (and which I’m using you as an excuse to share!!) is because I am in the process of being made an Irish citizen! I should get the confirmation of such later this year (unless they find out about my long criminal record as Carmen Sandiego 😉) and I’m excited to write about that once I get my new passport. With Irish citizenship comes free healthcare through the HSE. Because Ireland is part of the EU, I will have the right to live, work, and use public health services in any member state. My thinking is, if I truly intend this leanFI budget to be exercised in real life then I’ll simply take care of my medical needs while living abroad.

Should my medical needs heighten to require long-term treatments, prescriptions, or other care, I will luckily have that safety net to fall back on. I do specify above that your personal medical needs should be part of your leanFI calculations, which should include deciding how to approach health insurance when America withholds good health plans unless you’re employed.

But I still have hope the US will get with the program already and provide free healthcare. Keeping almost all medical services private does not a physically resilient population make.

Pingback:Monday Night Finance- Volume 108 | CountAbout