Let’s Talk Financial Inequality

To be clear, I’m no victim (today) of financial inequality. I was playing around with my numbers today in Mint, the free budgeting software I use to track my expenses and overall net worth. They have a feature that lets you check out how much your net worth grows over time; other nifty features include showing you “peak net worth” and “greatest change” to it. Color me surprised when the data unceremoniously informed me I grew my net worth by $20,000 this month.

To put this in perspective, I just made more in one month than some people make in a year. Specifically, I’ve made more in one month than 15% of US households have made in all of 2019. Now we already know I’m neither that disciplined in my finances nor actively involved with my investments. That increase was 100% passive. Yes, obviously my investments are doing what I want them to do and gain value over time. The issue is how outside the norm something like that is for millions of people in America. And for billions outside of America, to boot.

Financial Inequality is Nuanced and Hard to Tackle… or Inspire Enthusiasm Against

This disparity is thanks to the delightful concept of financial inequality. This rears its ugly head on all fronts:

- Access to financial education

- Financial literacy

- Income levels

- Generational wealth

- Debt

- Spending habits

- Government initiatives

All of the above play a role. I looked at the Wikipedia page for “economic inequality” to check out the more academic perspective on this. In the last paragraph of the intro this quote flew out at me:

Research suggest that greater inequality hinders economic growth…

Yep, okay. Research SUGGESTS inequality hurts economic growth in the same way common sense SUGGESTS swimming in a crocodile-infested river won’t turn out well. It doesn’t take a genius to see these suggestions being a very important part of reality. If the cure for cancer is locked inside the mind of someone barely making end’s meet, they don’t have much chance to give humanity that monumental gift.

The issue clearly isn’t convincing people financial inequality exists. I’ve got plenty of data and personal anecdotes to back this up. I had an uncle who loved crowing “We’ve been doing too much, for too little, for too long!” The issue is how hard of a struggle it’s been to combat financial inequality since times of antiquity. Governments at every stage of history, including today’s, have failed to make finances more equal across the nation via laws or programs.

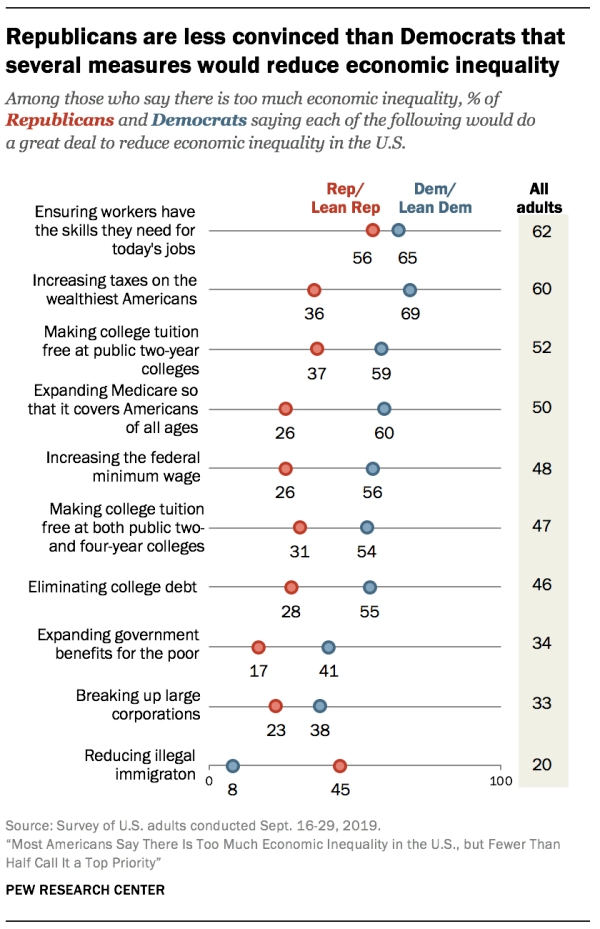

And of the top ten suggestions for reducing economic inequality in America, NONE of them have a good chance of being pushed into law.

In fact, under our current administration inequality’s been actively increasing This is thanks to less progressive tax plans and ZERO COVID-19 federal help since that one stimulus in MARCH. Is winning against financial inequality really this hard?

The Issues Contributing to Financial Inequality

The answer to that question is yes, so long as enough folks in power remain unwilling to change the social order. I mean, come on. If ONE rich guy can launch his car into space or nearly eradicate a deadly disease, I’m positive Congress’s hundreds of individuals can manage to help. Helping, though, would mean confronting some deeply entrenched cultural and social issues before we can even touch the financial issues.

Hate and bigotry/prejudice

This one is the number one reason we don’t do more for financial inequality. Humans are by no means perfectly rational creatures, a fact many a malicious and influential individual has taken advantage of. Class oppression is the overarching problem, made worse with racial, sexist, and ableist oppression to boot. It’s to the point now that we have scholarship on how racism is a tool specifically to keep lower classes divided. Labor-wise this leaves the lower classes without enough collective power to go after the rich. Holding back anyone from success who doesn’t pass as a man exacerbates the problems; so does preventing people with disabilities from holding their own in society.

We see this prejudice manifest in every major debate on social programs and legal practices. The Affordable Care Act passed ten years ago and is STILL a highly controversial matter. Its impact on people with disabilities and those who can’t get insurance otherwise seems to be overshadowed by cries of “government overstepping!!” and “CIVIL LIBERTY!!!” Women and other non-masculine people are routinely barred from higher political positions, even being judged negatively for traits that seem “positive” in others. And the racial wealth gap is just one of the dozens of ways BIPOC (Black, Indigenous, and People of Color) communities are routinely oppressed.

And hate only contributes to the complexities of the problem.

These marginalized groups struggle to unite behind one overarching movement. This is partly because there’s so much that needs fixing and partly because the powers-that-be make it that way. Lawful changes to lower financial inequality are anathema because it might help The Other that’s the cause of the country’s issues.

Lazy Millennials shouldn’t expect or hope for free college!

There’s too many freeloaders getting unemployment income!

Putting taxes on the rich will hurt my (debunked) trickle-down economics!!

As long as these biases persist, it’s going to be an uphill battle to create progressive policies against inequality.

Lack of opportunity including education. Financial and otherwise.

All of the above contribute as well to lack of educational and career opportunities. Attending an underfunded public school obviously warrants less chances for success than the most expensive private schools in the country. Same goes for family members, tutors, or invested mentors who ensure you learn robust money management skills. Financial education remains absent from most curriculums, despite 70% of America failing miserably at the simplest literacy tests. How can you expect to make informed decisions about what your elected officials if you don’t understand the numbers behind what they advocate for?

Better yet, how can you evaluate whether you’re getting justly compensated in your career when your misunderstanding of how tax brackets work kills your momentum? If you don’t have opportunity at the outset and never figure out where to find it, odds are overwhelmingly not in your favor.

Lack of compensation equal to productivity

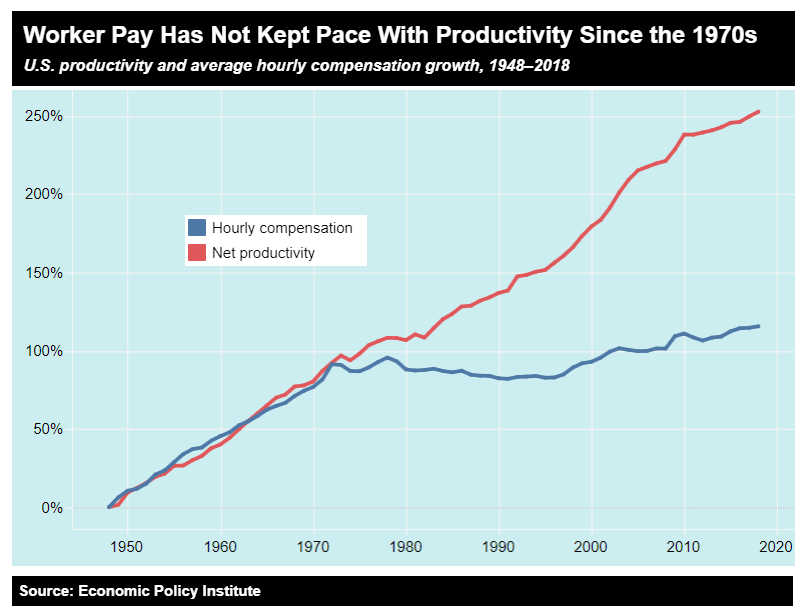

Let me point out a particular graph from this article, which is a horrifying read altogether on just how BAD income inequality is.

Now here’s the rub. Employees are working harder than ever, as evidenced by new psychological and technical efficiencies lighting the way (along with a worse work-life balance). Yet this new monetary value doesn’t make its way to workers’ paychecks. Instead, that money’s locked away for specifically those in the highest company positions. You’d think workers would come together and demand better for themselves. At least, until you remember the increasing unpopularity of labor unions combines with the lack of education and inherent divisions to leave workers perpetually unaligned and perpetually without the tools to begin aligning in the first place. Financial inequality is made worse when wages that properly compensate workers are withheld from them. I don’t foresee this ending anytime soon, not when the bulk of workers remain ignorant of how important they really are to creating the wealth their higher-ups enjoy.

Individually, It Doesn’t Have to be Bleak. Systemically, It Is.

I don’t point out financial inequality to conclude with “and this is why you’re broke and why life sucks!” It’s on the contrary: the more people understand the issues at hand, the more that awareness will lead to actually doing something substantial about it. It’s not to say that you can’t change your individual situation, either. It is very possible to get a high net worth on a small salary under our current system. Difference is, doing so is hard work with small rewards. It takes DECADES to do this. Decades which are filled with constant sacrifices and treading the line between thrifty and cheap. There is no option to improve your life via a careful expense increase; if you give an inch to lifestyle creep it’ll take a mile and leave you with even less than you had before.

If you have a high income, on the other hand, it does not take decades. Again, hi, I just increased my net worth by $20,000 thanks to Mr. Market. Doing so meant ZERO sacrifices on my end and ZERO tweaks/sacrifices/deviations from my current cushy setup. I might not be a dude and I can point out to times when this worked against me, but I’m also straight-passing, college-educated, able-bodied, and with skin whiter than a paper plate in a snowstorm. The system isn’t really working against me here.

Let’s call a spade a spade.

But just because I haven’t really suffered from these three things in my adult life doesn’t mean they don’t exist. Financial inequality is a worldwide problem, and the United States is one of the countries that isn’t dealing so well with it… despite being one of the most poised to combat it. America as a whole deserves the chances I’ve gotten in life, and a better financial situation should be at the forefront.

Cover image credit: Tomáš Lištiak via Unsplash

G’day Amy ,

Great read . You definitely have a knack in writing .

Financial inequality is definitely a WORLD problem .

The gap in inequality is definitely getting larger and unfortunately middle class is shrinking by the minute.

Wage growth is flat , Unionism dry as a desert and the list goes on and on .

Although here in Australia, we have a higher minimum wage , fairer health system and a higher standard of living than the average American , Financial illiteracy and inequality is alive and well , unfortunately!!! .

Happy investing, stay safe, healthy and hopefully America can get its act together regarding controlling Covid & looking forward to the day there are zero deaths .

Jimmy Pandolfo

Sydney, Australia.

Ugh, I too hope America will get its act together. You’re the first person from Australia who’s stopped by to say hi, thanks for commenting! I’ve seen a video in the last month or so from Australia representing your recent tax cuts for the wealthy with grains of rice (which looks like it was from Australia Greens). We’ve got the SAME issue in the States and it’s so frustrating to see that happening in another massive country. We’ll need a worldwide movement to make sure to combat this.

The over-categorization of office workers as “Salary” instead of “Hourly” is part of the reason why productivity has greatly out-paced worker compensation in the past few decades. Employers shifted most white-collar office jobs to Salary so they’re exempt from paying overtime. Then the company culture changed so everyone’s pressured to work more than 40 hours a week and be available 24-7. Office workers are the new 21st century slaves since they don’t typically have union protection like their blue-collar counterparts. The criteria for Hourly vs Salary wage workers put out by the Department of Labor under the Fair Labor Standards Act implicitly states that most jobs without supervisory responsibilities should be Hourly. Exempt job duties must contain the following: regularly supervises two or more other employees, has management as the primary duty of the position, and also; and has some genuine input into the job status of other employees (such as hiring, firing, promotions, or assignments). Most Salary office workers don’t meet any of this criteria. Office workers agree to this arrangement because there’s a certain prestige that comes with a Salary position. Who wants to punch in and punch out every day? However, this rampant misinterpretation of employment law has gone unchecked for decades and cost office workers dearly.

Not even that many blue-collar workers have protections nowadays thanks to the demonization of labor unions driving membership way down. I think a lot of businesses feel they can get away with the exemptions by naming folks “managers” in solely titles – at my last job, for example, I was a “manager” when the only company employees were myself, the owner, and a part-time intern. I see legal misunderstanding most hurting restaurant workers, especially in COVID times; even for the few that DO know they should legally be compensated the minimum wage every time, they’re often too intimidated by restaurant ownership to go after what’s rightfully theirs. It’s a serious shame; the access pipeline to lawful information is broken.

My net worth is up $243,000 so far this month. A crazy amount versus US annual median income. Can’t dispute I had a lot of advantages. And lacked some unfair disadvantages that hold millions of people back. But some advantages are random. Being good looking, being smart, having two loving parents that stayed together and being athletic are all things that lead to higher incomes. And they are all out of an individual’s control. They are a matter of luck, or destiny. Even with a completely level playing field those people will still have the most money. For that reason there will always be income inequality. But there could be a lot less of it.

Fully agree! I love your quote “there will always be income inequality. But there could be a lot less of it” and need to use that more often.