Investing During a Black Swan Event

There wasn’t much else to do other than roll my eyes when my work friend was laughing.

This was during the final week we were in the office before COVID-19 sent us home. This was also the week the stock market was tanking like mad. I kept bringing up to this friend “Hey, you should invest in your 401k!” ever since we were hired last summer, even going so far as sharing what mine was invested in (VTSAX all the way, baby). Because VTSAX is an aggregate of the overall stock market, its trading prices obviously reflected the pandemic turmoil. So, when the conversation turned to coronavirus worries, my work friend wasted no time to ask me “So Darcy, how’s YOUR 401k doing?”

My answer was “As expected,” not like anyone heard it. I didn’t elaborate on that answer because I know when to pick my battles, but on my own site I don’t have to! So here’s my longer answer to his question and the implications:

My investments are doing exactly what I planned on them doing. Taking a hit in the short-term is all part of the plan to reach a million dollars. Which I WILL DO, SUCKA, and if you were smart you’d take this opportunity and JOIN ME THERE.

Which, in my ideal world, would be followed by my moonwalking backwards out of the office blasting finger guns. Everyone else claps. I’m also give a promotion on the spot, because how could I not? I’ve got black swan investing down PAT and everyone else should follow that example!!

Wait, What Even Is Black Swan Investing?

Knowing what a black swan event means is actually more uncommon than you’d think; this might be why nobody clapped. The term comes from your likelihood of seeing a black swan – white swans are easy to spot, so when a black one shows up it comes as a surprise. You can never predict their arriving, either, which is why black swan events are named such. These are events that happen out of the blue, have far-reaching consequences, and deal a massive amount of damage on the economy. The coronavirus epidemic fits this description to a T; who would have known the world would shift to introversion in such a dramatically short time?

Likewise, black swan investing is a term I made up to mean “investing straight through the storm of a black swan event”. Because I know the market overall will always go up, this time of uncertainty changes absolutely nothing about my investment strategy. I’ll continue buying more index fund shares as my paychecks come in. Thanks to some outrageous luck, I still have an income that allows me to do this. Odds are, so do you (and if you don’t, I touch on that here). In an ideal world – yes, the same one where I get the clapping and promotion – you will also have the means to undertake black swan investing and come out further ahead.

Why Investing Right Now Seems Counterintuitive

Unfortunately, we do not live in that ideal world of mine. (If we did, we would’ve been a lot better prepared for the widespread consequences, but I digress.) I wasn’t able to explain to Work Friend exactly what he was missing out on by not investing. It’s true I saw a 30% drop in my net worth over a couple of weeks. It’s also true it could go down further than that, especially as one in ten adults are now out of work. That number will only increase thanks to the government’s poor control over the virus spread.

And because of that poor control, the situation seems out of control for tens of millions out there. Less than one percent of the US population managed to get tested, and those that test negative for the virus might have it after all. Businesses continue to close, employees continue to lose their jobs, and who knows how many people are getting sick with a permanently-damaging disease. So WHY, in the name of ALL THAT IS HOLY, should ANYONE be worrying about INVESTING???!!!

Put in this light, yes – investing right now seems unnatural and downright callous. We are all in danger, and danger makes our emotions and instincts scream up to the surface. This was perfect for the fight-or-flight scenarios at the start of human history. Now, things are much more nuanced. Now, you need to tamp down your immediate reactions and think through what the best course of action looks like. And right now, despite the naysayers and doomsayers, that course is “keep calm and carry on”.

Black Swan Investing In Action

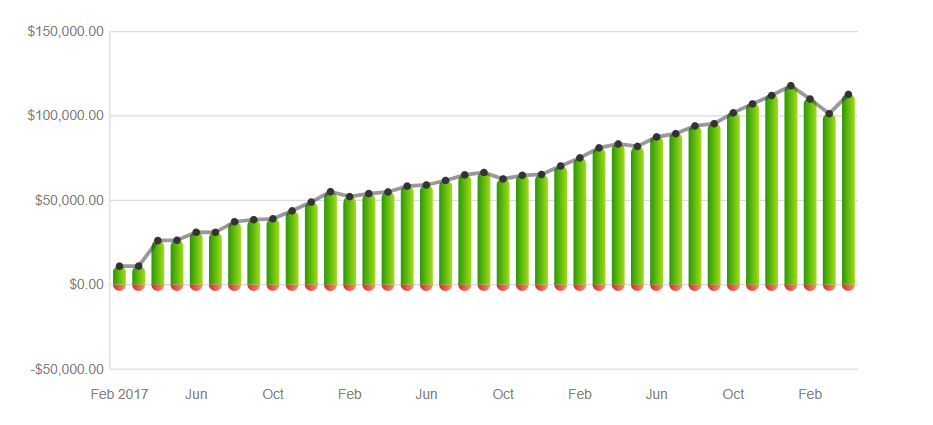

Already, the buy-and-hold method is showing me it’s the right one. At the market’s high in February I was worth somewhere between $125,000 and $130,000. By late March that tumbled down to $87,000. Seeing that $40,000 drop to my net worth might’ve worried me if I didn’t already know that would happen. My peers that lived through the 2008 recession have shown doing this meant they didn’t end up losing money. Black swan investing is a necessary part of wealth-building, even if it feels unnerving.

Guys, the market goes down sometimes. That reality needs to be built into your plans in case it ends up affecting your career or income. The markets don’t go down in the long-term, but does in spurts when something collapses. In 2001 it was the dotcom bubble, in 2008 it was the housing bubble, and in 2020 it was the cult-of-personality bubble (“No way will this virus affect MEEEEEE”). Although you don’t know when it’ll happen or what will cause it, you know bear markets and recessions will inevitably happen in your investing timeline.

So when it comes to investing for more than ten years, you will see your investments go down in value eventually. You cannot get rich without taking risk.

The reverse might also look true, that you cannot take risk without being rich. It’s similar to the bemoaned issue: can’t get a job without work experience, can’t get work experience without a job. It’s common, though unspoken, belief that you can’t take risks without riches, and you can’t make riches without risk. And, in the poverty mindset, you can’t win. The ONLY way for you to get there is to get out of the poverty mindset, which is one of the greatest gifts you could give yourself.

Watch Out for Pitfalls and You’ll Stay Golden

Yes, it involves sacrifice – everything worthwhile does. In this case, it requires your time and energy. If you feel you don’t have one or both of these resources to spare, you’re kidding yourself. There is a way to dedicate the time and energy to this. It’s not easy, but it’s possible. It is real. It is yours and waiting for you to take it. How long are you going to make it wait? How far into the future will you relegate the version of yourself you want to be?

Do NOT let fear dictate your direction in life. Don’t let it take advantage of the pandemic and make a bad situation into a worse one. If looking at your tanking investments will frighten you into selling, don’t look at them. If the news cycle is accelerating your feelings of anxiety, stop tuning in. Anything that will prompt you to panic-sell is best left unacknowledged and without engagement. We don’t need you to spend your energy on what will hurt you.

Stay the course and continue to invest in index funds. Don’t sell off what you already have. If you don’t have anything, it is time to invest now more than ever.

Remember: the drop in value was expected. It’s going to go up again, and you don’t want to be left behind.