My 2024 Finances in Review

The team-of-one at We Want Guac proudly presents: Darcy’s 2024 finances in review!

2024 Spending

This is the first year I’ve spent living in Los Angeles! I expected my spending to go up a little, similar to last year. It went down instead, much to my surprise. For reference, here’s how much I spent every year since 2017:

| Year | Spend |

| 2023 | $45,969 |

| 2022 | $46,647 |

| 2021 | $43,442 |

| 2020 | $30,722 |

| 2019 | $29,999 |

| 2018 | $24,985 |

| 2017 | $13,280 |

I’ll be adding a new line to this table soon.

Total spent in 2024: $42,228

That is 9% lower than 2023 and 10% lower than 2022! This was without me even trying to keep it down as well. There were a couple of reasons for this that worked out in my favor:

- No international trips this year 😔 Instead I took several trips to other parts of the country I’ve never seen before, including to Utah, Oregon, Minnesota, the Grand Canyon, and The Big E in Massachusetts.

- I flew cross-country twice for my college friend’s bachelorette and wedding, but I used airline points both times to save hundreds both ways.

- While I had a new apartment to furnish, I already knew how to either dramatically lower the coat of furnishings or get stuff for free. The most expensive piece of furniture I bought was a new sectional sofa with a pull-out bed and storage. It cost $350 😈

That spending metric would be even lower if I didn’t include my first months’ rent and security deposit on a new place. That would knock another $4,265 off of my yearly spending for a new total of $37,963. And, according to the Bureau of Labor Statics inflation calculator, that’s roughly the amount of money I spent in 2020. It’s wins all the way down!

SPEAKING of wins…

2024 Savings

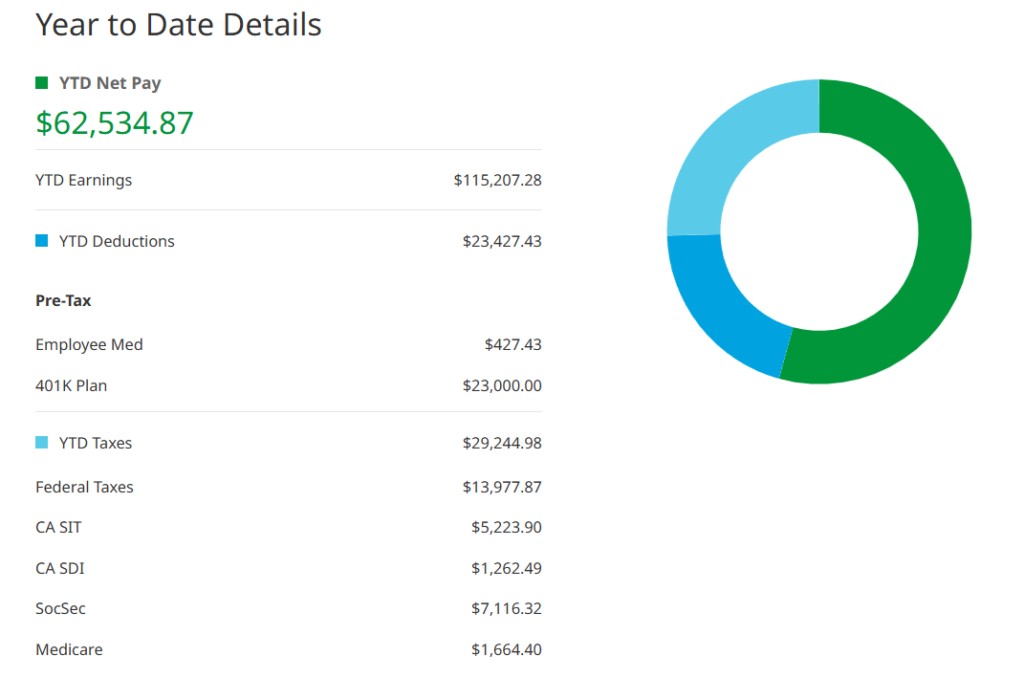

I’ve now completed Year 4 of making six figures and the first year where I made six figures off my annual salary alone. My net pay increased a little bit, defying my grandboss’s prediction that the California taxes would make it decrease. He was still right in his own way; I paid about $3k more in total taxes than I did the year before.

I got a raise halfway through the year from $99k base salary to $102k. In September, the company 401(k) match rose from 4% to 5%. That same month, my company also offered a $150 bonus if you took a financial literacy module. I was obviously all over that and nailed every quiz for that extra bump to put me over $120k compensation.

I first hit $100k comp in 2021, so it’s nice to see this increase by 16% in three years. Now, I could prioritize getting a higher-paying job as I’ve gotten a few opportunities in the $150k range. I haven’t pursued that because my current job is just that good for work-life balance. (And for other reasons I get into here.)

You might notice I did not contribute to an HSA this year. I’m a big advocate for using all tax-advantaged accounts available to you, hence why I maxed out my 401(k). As another surprise, it turns out my low-cost California health insurance plan is so good that I am no longer eligible for an HSA. Which, eh, is fine. My company made up for it by bumping up the 401(k) match this year to 5%. Since I contributed at least that much every paycheck, I got more free money to the tune of $4,878.86.

Always do the most to get that 401(k) match.

SPEAKING of free money, I mentioned before that my company equity is now earning me some solid returns every quarter. In 2024, I got another $3,850 total from that income stream. Here’s another chart to itemize all of my full-time employment pay:

| Income Source | Total |

| 2024 base salary | $101,789.69 |

| + bonus ($13,267.59) | $115,057.28 |

| + 401(k) match ($4,878.86) | $119,936.14 |

| + fin lit bonus ($150) | $120,086.14 |

| + profit sharing ($3,850) | $123,936.14 |

My total 2024 savings – including my 401(k) contributions and match, my equity profit sharing, and what I didn’t spend of my net pay – amounts to a little over $52k. Spoiler alert: all of this contributed to a gangbusters year in net worth growth. Well, that, plus a fantastic stock market return.

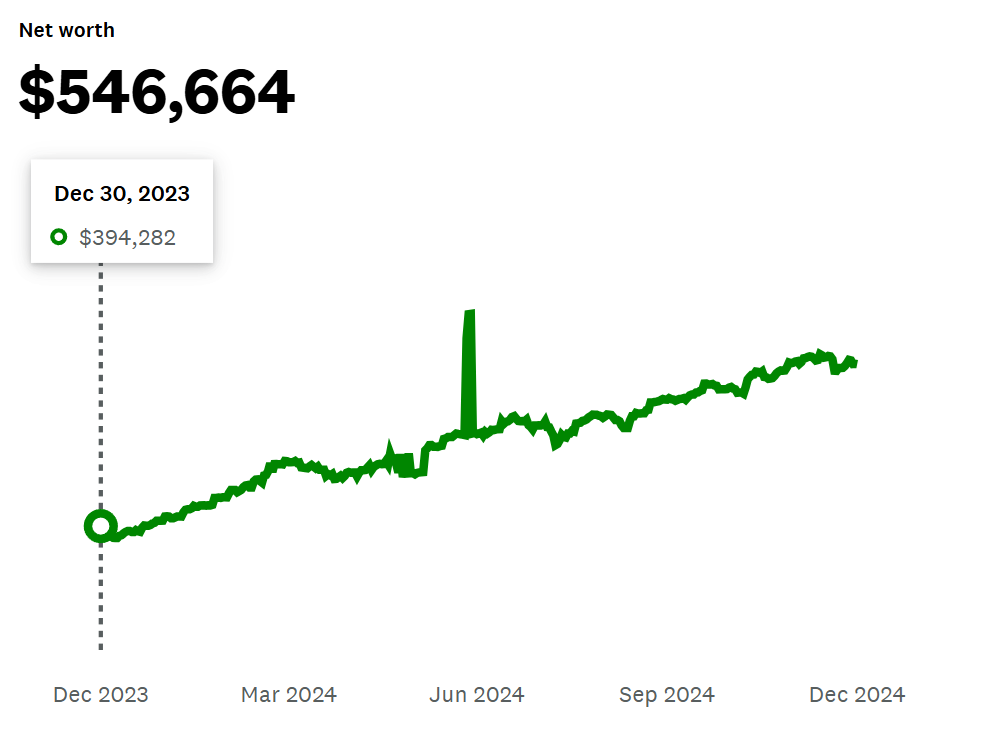

2024 Net Worth Change

The overall stock market grew this year by over 25%. Since I have most of my money in index funds, I, too, saw this gain in my portfolio. At the end of the year in 2023, my net worth was $394k. This year saw that grow by over $150k to where it is now at $546k!

(Note: that weird spike in June is thanks to the software accidentally counting one of my accounts twice. I don’t know how to fix it in the software and I’m too lazy to Photoshop the screenshot.)

Not only did I reach my LeanFI number, I blasted right past it and kept on climbing! It would allow me to safely spend over $20,000 per year in perpetuity if I chose to retire here. I’m very comfortable with that, and the understanding of how much it will grow thanks to compounding. It makes me that much more hopeful and confident about the future.

To add, that net worth return is roughly the same as 2023’s return. Which is to say: high as balls. I’m super pumped to see this and am already bracing myself for negative returns in 2025. This won’t mean I’m changing my investing strategy in the slightest; I just can’t bring myself to believe we’ll see that high of a return for the third year in a row. What I’m gonna do instead is bask in the glory of having half a mil and watching that compound me into becoming a millionaire. 😈

Also interesting to note here is that the last two years’ of returns means I more than doubled my net worth in two years’ time. If I pulled off that hat trick again, that’d make me a millionaire by the end of 2026. Can you imagine??

Smaller Factors to Increased Net Worth

Two other income streams I haven’t mentioned yet I have would be the interest Ally Bank pays me in my savings account, and the dividends I get as a consequence of investing in the total stock market. Ally Bank’s current APY is 3.8%. I keep my emergency fund with them and finally increased how much I keep in there for that. Because of the higher amount, I got a higher return here at $277. My spending account, failing to keep up, netted me a whopping $1.05 in interest.

My 2024 finances further netted me $3,473 from dividends paid out by my taxable account and Roth IRA. Woo!

My Personal 2024

If you divide my spending by my net-income-plus-401(k)-contributions, it’ll show I’ve saved half of my full-time pay! Including other income streams in that calculation bumps the savings rate even higher. I’m really glad my spending habits still stayed steady in the midst of learning a new city and culture.

There’s still things I miss about living in New England: the fall weather, the regional specialties (like pure maple syrup), and my friends over there. But in a surprise to me, I’ve made many more fantastic friends in one year here than I would have in the next five years in Boston. I’ve written MULTIPLE screenplays, from several short films to several episodes of a faithful Count of Monte Cristo adaptation, which absolutely needs to happen and what it’s long overdue for.

My medical condition continues to suck, but I think I’ve finally turned a corner on understanding how to see symptoms coming on the horizon and prep for when they hit. This is in opposition to my thrilling previous strategy, where symptoms hit with no warning and I scrambled to deal with them alone. Now, I give myself the grace to take a day off if that’s what my body needs. I no longer try to do something productive every day like I used to. My overall productivity has stayed the same, and actually increased a little in some areas as a result. I guess you call that personal growth. I like that I’ve grown in that way. 🙂

Looking Ahead at 2025

Uggggghhhhh. 2025. Trump is gonna be president and Kaiju may or may not wreak havoc upon the world. Because of my strong 2024 finances, I can weather almost any big curveball life throws at me; this means my worries for next year aren’t primarily for myself, but for everyone else who do not have the resources I do. Should things go bad, I can always retreat to Ireland for safe harbor.

Should things go horribly wrong, I plan to buy a crumbling castle in Ireland and have my friends and loved ones live there to help me renovate it/deal with a sea of historical renovation paperwork. “Pray for the best, prepare for the worst” is a mantra I slam my rubber stamp of approval on all day, every day.

As for spending in 2025, I do believe it will increase again. I moved into a new apartment with a higher rent payment of $1,995 a month, which is about $250 more than what I had been paying. I’m also taking a trip to France with a couple of French friends of mine. They organize a trip every year and have already given me some details, including how we’ll stay in a countryside CASTLE with a private chef! It’s gonna be a blast and a half!

And that just about wraps up 2024! Here’s to a peaceful 2025, if we can get away with that!

Cover image credit: Jonatan Pie via Unsplash

Glad to see the NW update! I was close to 600k when you posted the 500k NW update just 3 months ago! Crazy how you went from 500k to almost 550k in just 3 months! Maybe 600k by spring 2025 and 700k by end of 2025? LOL

I closed the year with 630k, since I have been hoarding cash instead of investing my leftover paycheck into the market because I’m planning to leanFIRE this month, so I need 2 yrs of expense in cash. My plan is that if either 2025 or 2026 is going to be a bearish year, then I won’t be withdrawing during a down year, because I will be living off my saved cash. Or, if neither 2025 or 2026 is going to be a bearish year, then after 2 extra bullish years, my net worth will have compounded enough that I will be at a much lower than 4% WR, so I don’t have to worry about withdrawing in a down year anymore.

Firstly: CONGRATS ON (almost) LEANFI HANNAH!!!! You’ve got a fantastic plan to mitigate the sequence of returns risk by building that cash cushion; excellent work!

Secondly: yeah, $50k in 3 months is nuts! If 2025 is bearish I still miiiiiiight get to $600k in that time, but if I hit $700k I’m gonna stop paying attention, because I’d have clearly entered a fantasy universe and will have bigger problems of the dragon/unicorn variety 😉

What an amazing year you’ve had in 2024! What a fun year to be an investor. We have similar financial journeys & NI, and I always appreciate reading your updates. Thank you! Keep going!

Glad to hear that Michael! If our financial journeys are so similar, then congratulations to you too for a great year!! 🥳

Hello how are you doing during the LA fire? Please let us know if you and yours are safe.

Yes I am safe! I had to evacuate last week, but luckily the fire threatening my neighborhood (Sunset fire) was contained very quickly so I am now back. There’s no injury to me or damage to my place either, great luck there. I still have my go-bag packed and wear masks outside just in case. Thanks for checking in 🙏

Hi Darcy,

Really enjoy your blog! I am one of the fortunate handful of people amongst Gen Z who will be entitled to a pension from working a government job. I just have a couple more years of service until it vests and then I am entitled to a monthly payment for life starting at age 52 at the earliest. (Albeit it’s a truly tiny amount if I “declare retirement” from that particular pension system at 52 years old).

My question is how should I account for a pension when it comes to FIRE calculations? Do I include the principal amount (money that has been mandatorily deducted from my own paychecks) as part of my net worth

Hi! Feel free to email me with more specifics at darcywantsguac at Gmail; if you do, I’ll connect you with my friend Sam who‘s THE expert on FIRE as a government worker (formerly known as GovernmentWorkerFI). But short answer here, I think it’d be easiest to count in your FI calculations by subtracting your projected pension payments from your expenses. I found a good Reddit thread here and more at r/govfire with helpful comments on how else to count it.

Pingback:6 Reasons I’m Chill with Tariffs Wrecking My Investments - We Want Guac