We Want Guac Turns FIVE! Or: The School Years

This month now marks half a decade since I first hit “post” on We Want Guac! My blog is now officially old enough to enter kindergarten. If this site had a corporeal form, I’d totally have ‘em pose with one of those sendoff signs on the first day of school.

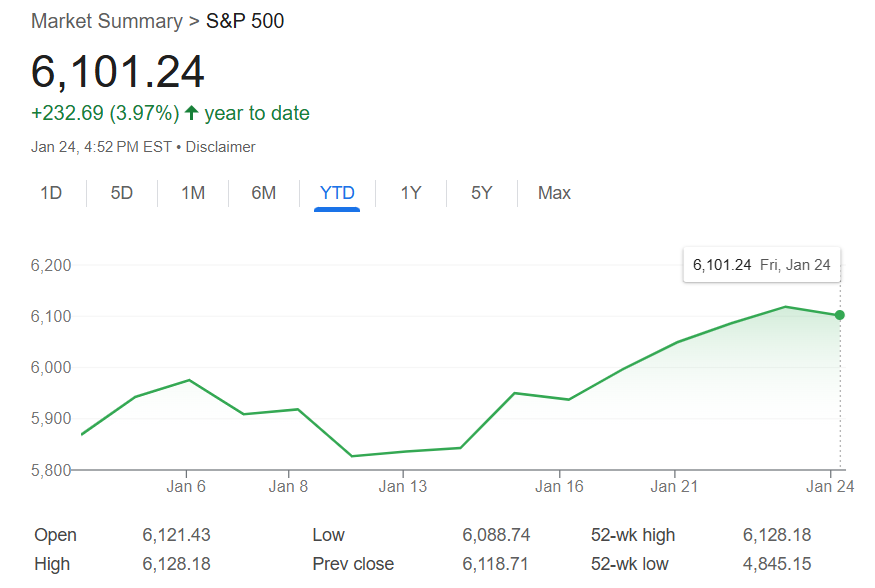

This is also the first time in years I’m writing a year wrap-up without making it a double-post celebrating the latest net worth milestone. I kind of don’t trust my current net worth anyway, which is at $560,000 as of today. What do you MEAN, the S&P 500 has already seen a 4% return for the year before we’ve reached February???

(Note: I know why and the simple answer is “fascism is profitable in the short term”. No, that is not an exaggeration. I may write an article on the topic now that I’m thinking about it…)

I like looking back at the year to help me see from a better angle than the default human one of life day-to-day. Let’s start off with 2024’s greatest hits!

2024 Blog Highlights

Nailed my goal of 12 articles, or an average of one a month!!!

Admittedly, I reached this goal by the skin of my teeth; the twelfth article went live on New Year’s Eve. But a goal reached is a goal reached, and I sure hit it!

Maintained average of 5k visitors per month

Since I don’t prioritize monetizing, that’s a great amount of traffic! I like to think you guys reading my stuff are here because your passions match mine. Quality over quantity 😊

Kept receiving lovely commenters on my site

This is a shoutout to you reading this. I don’t send out email alerts anymore when I have a new article, so it takes effort to stay up-to-date. I am so deeply grateful to you for choosing to keep reading what I write. THANK YOU for not only checking in with me so consistently, but choosing to engage with me by leaving comments!

I hit a $400k net worth, then a $500k net worth

They sure aren’t kidding when they say compound interest is magic! I hit a $400k net worth milestone in early 2024, then a $500k net worth milestone in fall 2024.

Here’s what’s particularly crazy about these milestones. If the stock market grows by 25% in another future year, I have enough invested to see over a hundred grand added to my net worth. If any of you creeps out there look through my windows, you have a nonzero chance of spotting me hopping around my computer screen showing my latest returns/calculations and going “Oh what! What! Look at that! That’s so much money! AAAAAAAH!” But you don’t need to do that, because I already metaphorically hop around and yell on this site anyway. 😉

I got Irish citizenship!!!!!!!

I’ve talked about this it in at least a third of my articles this year. But yes, I am now formally Irish-American with dual citizenship in both countries! And in my opinion, Ireland is the best country to pursue citizenship with. Yeah, there’s the self-centered benefits of an Irish passport, EU/UK privileges, and much more affordable healthcare options. But more importantly, Ireland’s moral compass as a whole is second to none. I feel joy and pride when I see the latest news on Irish work on the world stage. It’s nothing less than an honor to now be counted as an Irishwoman.

Now, let’s look at the not-highlights:

2024 Lowlights

My company did multiple layoffs

In 2024, I got worried I’d get laid off so I wrote an article on how to prep for that. Turns out, I wasn’t getting laid off – despite seeing my company posting a job ad eerily similar to my role. I’m still employed at the same place; that was just a worry I didn’t need. However, many of my coworker friends DID get laid off. Post-layoffs, the company offices are now much less diverse than they were before. Yet another reason for pro-working remote, as the less diverse a group is the more susceptible to stagnation and groupthink. In other words, not an environment I’d be happy to spend my days in.

Several blogs I admired closed up shop

Many of the friends I’ve met through blogging are now either no longer blogging or blogging only sporadically. I know this is a known phenomenon in this space; I also know that it’s rare to see sites chugging along for longer than 3-ish years, with many more quitting less than a year in. I’m just sad to see that because I love reading their output. Makes me very glad I got their contact info when I did so I can still text them to hang out.

It’s harder to connect with others via social media

I used to be much more active on social media, especially in the broader personal finance/FIRE community. I quit using Twitter after a leader took the helm I deeply disagree with. Had that not been a dealbreaker, the user experience subsequently going downhill sure would have been. Several of my friends in the space did the same thing and stopped posting to the platform. As correct as that choice was, it sucks that we no longer have the centralized gathering space. Now, everyone is spread out across different platforms like Instagram, Threads, and Bluesky. I’m hoping one of these will become the go-to for finance people; until then, I’ll keep posting sporadically on Instagram.

Favorite 2024 WWG Articles

For these posts I feel like it’d be easier to point out the ones I liked the least, because otherwise I loved them all. The one I liked the least was the one about getting your first credit card. I wrote it because I felt it was a needed reference point for a basic requirement of modern adult life. That doesn’t mean I felt particularly excited to nail it down.

Every other post in 2024 was a joy to write; for that one, it was more like “eh, I see a need for this so I guess I’ll fill it”. It was also about a topic I feel is written about to death, but at least my writeup is straightforward and with minimal ads.

Otherwise, there are three article in particular I’d like to spotlight here!

The Cross-Country, $1000 Road Trip (and Move!)

How cheap can a road trip get? Very, as it turns out! I still feel pride in myself for making this cross-country road trip happen!

How to Calculate Your LeanFI Number

It’s funny that, in the financial independence community, the definitions on LeanFI and FatFI are up to interpretation. That’s why the keyword in “personal finance” is PERSONAL, baby!!! Here, I lay out my argument for MY definition of LeanFI (tl;dr: it’s what you need to just survive on the bare basics).

Figuring Out My Timeline to Retirement! (Or “Other”)

The tl;dr of THIS one is: I don’t know! My retirement date is not set in stone; I suspect I will choose it spontaneously! But there are several factors that influence my decision, which are all laid out in this article. This was one of the most fun to write!

Looking Ahead After 2024

Now we’re here, in the Common Era year 2025. This was supposed to be a year of measuring progress. Loads of statisticians and international programs use it as a benchmark; I don’t know how many times I’ve heard or read about X statistic reaching a certain point by the year 2025. Instead, I’m looking at a year of uncertainty that is fully due to politics affecting me and people I care about.

We’ve established I like history. Since history repeats itself (or, at the very least, rhymes) I’ve been able to use historical periods to predict what’ll happen with pretty good accuracy. So when I say I’m very concerned about a party in power displaying symbols of hate and signing orders to officially discriminate against marginalized groups, know that my concern does not come lightly or frivolously. I do not use the term “fascist” lightly either, so understand I mean it when I say that the current American administration is operating under fascist ideals.

This would be bad for me as someone with empathy, or a simple wish for my fellows to find a path forward via meritocracy, not oligarchy. Some inherent traits of mine – namely, my being a bisexual woman with a moderate-to-severe disorder – puts me in further danger under fascism.

That being said, I’ve already gotten to a position that will protect me well if the worst truly comes to worst. Not only do I now have the legal privilege to have my pick of European countries to retire to, I can do so with financial ease. Those two factors alone obliterate the most significant hurdles those looking to move elsewhere usually face. I feel secure about my planning, whatever is to come.

What’s Next if 2025 is Positive?

There are a few things I’d like to keep up on 2025. On We Want Guac, that’d be posting twelve more articles again (eleven after this one!) and maintaining at least 5k monthly visitors. I have another article idea marrying finance with The Count of Monte Cristo, so I’m looking forward to cleaning that up and hitting “Post” later this year.

I’m also looking forward to a trip to Italy in May with my brother! I offered my brother an international trip together as his college graduation gift. He chose to visit Italy to explore that part of our family roots. We’ll be concentrating on where our paternal grandfather’s family is from in northern Italy and exploring some cities that keep appearing in my brother’s genealogy research. The one I’m most looking forward to is Belluno. Fun fact: in the local Venetian language, Belluno translates as Belún. My inner child is ecstatic my family history ties with a place called Balloon. It already looks like something out of a fairy tale:

I’m also projecting to reach a $600k net worth in 2025.

This is assuming that I save at least ten grand (or a fifth of what I saved in 2024). This also assumes the stock market delivers another six percent more for the year, to reach the 10% historical average annual growth. It’s really fucking nice to see my financial strategies continue to work out for me. While said strategy came about from doing hard research and listening to people much more knowledgeable and experienced, there’s never a guarantee it will work out. I went ahead anyway because I’d still be better off even if it didn’t work out.

I wouldn’t be able to maintain my current lifestyle if I was forced to quit tomorrow, but I’d still be well off enough to have a damn good life. That is the clearest indicator that my 2025 will be pretty good. I’m glad I had such a good 2024 to continue setting me up so well.

Cover image credit: Ihnatsi Yfull via Unsplash

Family photo image via Reddit

S&P 500 returns tracking via Google

Belluno photo via Wikimedia Commons

Always good to read your content, Darcy! Your writing skills are excellent, its just a pleasure to read what you write. You are absolutely killing it with your financial progress and what a beautiful family! And how generous to treat your brother to a wonderful trip. I think that generous spirit shows through in what you post. The friends in my life I most admire and enjoy are like you in that way, they are generous towards others. Its a great personal trait. Best hopes and wishes that 2025 will be a wonderful year for you.

Thank you Steve 🥹 May your 2025 also be wonderful!

Always happy when I randomly check your site and there’s a new post! You’re an excellent writer. Here’s to $600k!

Thanks so much!! Yep, here’s to the next milestone! 🍻

Hi Darcy,

If you’re able to make it work with time zones and such, it would be prudent to make a plan to move to Ireland sooner than later. Things can go downhill very quickly. I am stuck here because I am caring for an elderly parent so I can’t follow my own advice, but who knows if the borders will close. Take care.

Congrats on the great progress!

Apologies if this is too specific of a question – feel free to pass on it if you’d prefer. And maybe you’ve touched on this elsewhere (if so, please let me know).

But curious if your early FI journey/progress/goals are topics you get asked about or are discussed ever at your day job? Like if/when managers ever ask about say medium to long term career goals, will you talk about early FI? Or have you found it a difficult or topic to bring up? Genuinely curious because you are further along than I in the FI journey, and I foresee this as a potentially challenging or delicate situation (but maybe not). And curious if you’d be willing to share how you’ve handled it.

Hi Frank – I’ve never been asked about FI at work, which I chalk up to finance being the ultimate taboo topic. It’s rare for managers to ask about my career goals, but if they do ask I suppose I’d talk about maximizing my impact while maintaining my work-life balance. There’s no great benefit to bringing up the FIRE movement in a corporate setting, nor is it necessary – pursuing FI is a private matter that I don’t need to publicize to my colleagues, much like I wouldn’t publicize my religious beliefs, health issues, or relationship details. Hope this helps.

Can’t wait to read about the Count of Monte Cristo and finances!