Where Did My Money Come From?!

“Okay, Darcy, we see the line in the sand. You have great ideals and all, but why should anyone listen to you? Ever?”

Because I’ve lived it and can teach you to do the same thing.

“Pics or it didn’t happen.”

Can’t argue with that. Here’s the pics you asked for:

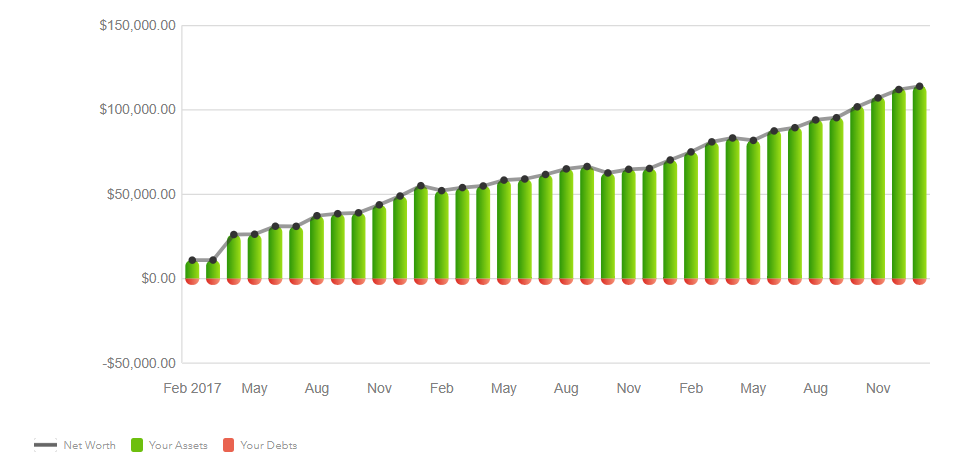

Both are screenshots from Mint, the budgeting app I use daily. Besides keeping me on top of my budget it has lots of other nifty tools, like tracking my net worth over time and making pretty graphs for me to look at*.

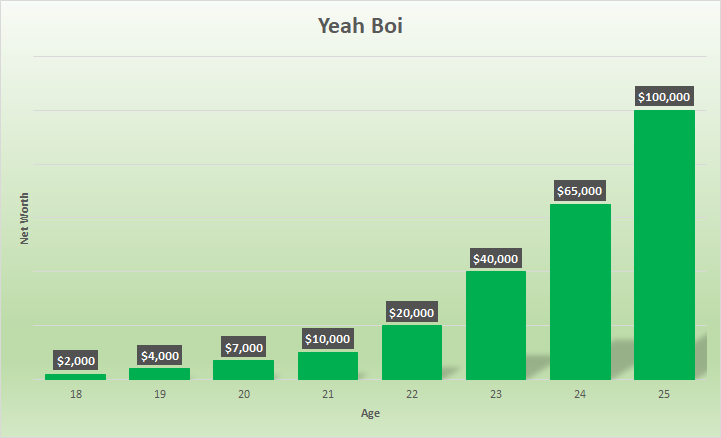

That net worth graph, however, only shows you the data going back to when I first downloaded Mint. For a fuller picture, here’s my net worth from every year I’ve been an adult:

18 years old – $2k (18 years of the occasional odd job and birthday money)

19 years old – $4k (from campus job)

20 years old – $7k (campus jobs and summer temp work)

21 years old – $10k (amount saved up from temp work and all of my jobs)

22 years old – $20k (added 10k during first job out of college)

23 years old – $40k (got a raise! and the S&P index was up ~20% this year.)

24 years old – $65k (got a new job!!)

25 years old – $100k (got a raise, and then a new job offer later that year)

No, I didn’t create an app or website or cool business. I don’t even have that many followers on Instagram. This is literally what came from two things:

- Saving a big chunk of my salary, and

- Investing in an index fund.

“Duh, Darcy. I may not know what an index fund is but I do know I can’t replicate this! This is too unattainable for me, you CLEARLY cannot help me!”

Not with that attitude, I can’t. Be someone that’s achieved retirement in your 30s and folks complain it’s too unattainable, implying they can therefore learn nothing from you. Be someone that’s achieved anything of note, really, and someone will complain it’s unattainable.

Newsflash: it’s not. Even if I had $50,000 in loans to pay off I’d still be debt-free and worth tens of thousands by now. There’s something very insidious about discouraging others before they begin and scrambling to remove any seed of hope. DO NOT give in to despair. That is a cesspool that will leave you dying in misery and mediocrity.

There are several things that helped me reach $100k at 25 years old. There are also several things that would have made me richer if I was more extreme with it, especially if I took the advice of every finance blogger I came across. Take what you can apply to your own life and start climbing your mountain. You don’t have to be anything like me to do it.

Where Will My Money Go?

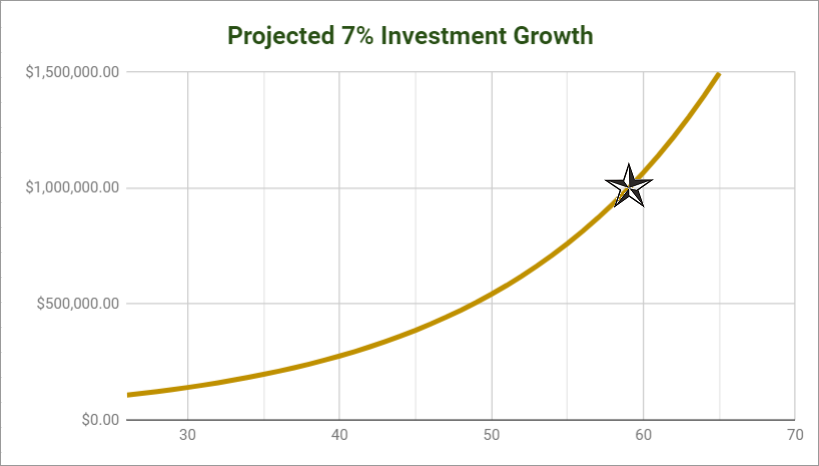

You know already I’m assured of the fact I’ll be a millionaire. This figure assumes a lot of things, including that the overall market will reflect the historical average of 10% returns over the next four decades. Another big assumption is that I will not touch this invested money until I hit traditional retirement age. Anything can happen between now and then, so I can’t say for sure it will stay untouched. Because of this, it’s hard for a lot of people to conceive of the future, let alone plan for it.

Nevertheless, I’ll keep climbing. No matter what life throws at me, I’ll be better off having the money than not, especially if I don’t touch it for the longest amount of time possible. If I succeed in not touching it, this has 35 years to grow in my Roth IRA and taxable accounts. Both are mostly in S&P 500 index funds (shoutout to VTSAX!) with some bonds to smooth the ride.

My current expenses are $30k per year in a HCOL area, with roughly $20k of that for rent alone. This makes me sad. But my budget makes it so I’m still hitting my money goals while not depriving myself. This makes me happy!

“Duh, Darcy, that would make anyone happy. What are you saving all that money for, though?”

That is an excellent question, because no one should save money simply for the sake of saving money. You should give a job to every one of your dollars, whether it’s spending on something to boost your life quality, kept in reserves in case of an emergency, or in an index fund making more money for your benefit.

Now that I have my retirement fund taken care of, I can use the rest of my saved money for other goals. As of now, I plan to raise enough money for the next few years to either buy a home somewhere else in New England** or go on an outrageous trip around the world a la Millennial Revolution. Or both, if I decide to rent out that home before leaving on said trip!

Where do you hope your money will take you? What steps are you taking with your money to get there?

*I know a lot of blogs are paid to recommend things to you. Not this one; it’s too new to draw those affiliates! This is a rec done fully because it’s a great product, FREE, and super helpful.

**As much as I like living in Boston, it’s WAY too expensive. Maine or New Hampshire prices are more my speed 😉