A $400000 Milestone Update: We Want Guac Turns 4!

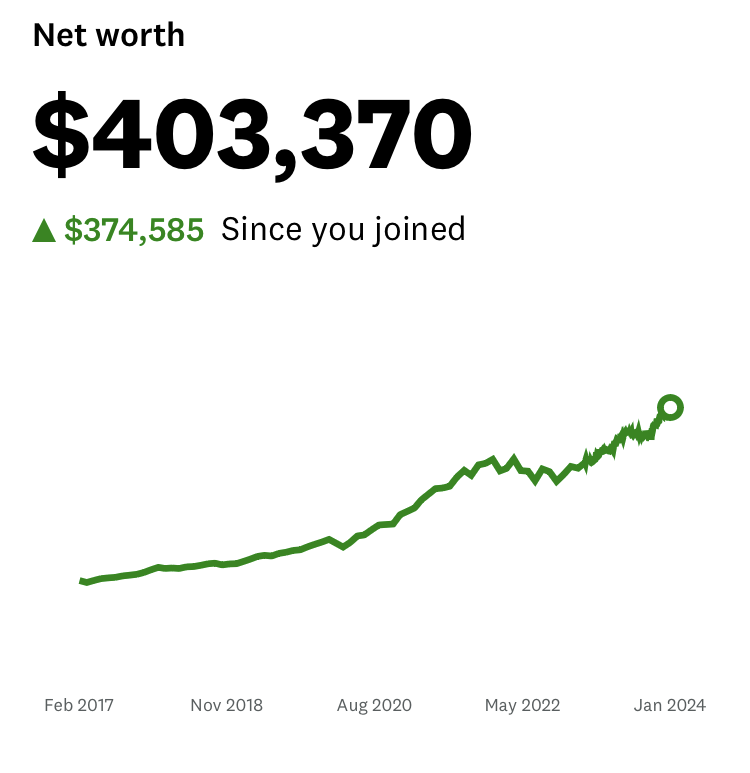

I crawled out of bed this morning, settled into the living room, and started my workday. Then I remembered it was the Tuesday after payday, which means my 401(k) is updated with my latest contributions. And NOW, after months of flirting with the milestone, I have officially reached a $400000 net worth!

This month, I’m also celebrating my blog here turning 4 years old! I find it fascinating that I’ve seen my net worth roughly correspond to how many years I’ve been blogging. Year 1? $100k. Years 2 and 3? $200k and $300k, respectively. Maybe the trend will continue as we go forward? 😉

The ride itself to $400k in the last year was mostly boring. The rest of the financial independence (FIRE) movement warns you about this, and here I am joining the choir. I hit $300k in March and saw it ramp up to $350 in a matter of weeks. Then it stayed around $350k for months. Several months, actually, until November brought the holiday season in full swing. That woke up my portfolio and it roared up to the new $400000 net worth milestone.

So what does that change for me, if anything?

My New $400000 Net Worth Opportunities

I’m really happy to note I doubled my net worth in 3 years’ time. I first hit $200,000 in February 2021 and things have kept improving for me since then.

$400k means I can now spend $16,000 each year and likely never run out of money. According to The Earth Awaits, I can go on to travel the world and only spend that much.

I also know someone who’s done it with roughly that amount. My friend Purple chilled for months in gorgeous countries like Thailand and Argentina while spending around $16k in 2022. While I’m not planning to go that route for at least another few years, it sure is tempting.

$400k is also the rounded average for home prices in the United States. In a shock to me, that’s enough money to buy a condo in the city of Boston TODAY, all cash, and STILL have money left over for fees/taxes/other inescapable surcharges in modern society. (Admittedly the cheapest condos possible, but still.) If LA treats me well, I could return to New England and become landed gentry a homeowner with no mortgage! Another very tempting route I don’t plan on taking just yet.

What IS the route I’m gonna take, then? I do plan on continuing to work for the time being. Should I stop contributing at all to my investments, $400k is enough to make me a millionaire in only 10 years with average returns (!!!) That officially means I can become a millionaire in my 30s. “Can” being the operative word since nothing is guaranteed. But with that said, this is more of a guarantee than most get.

Fun $400,000 Net Worth Spending

As a fun exercise, here’s how much I can spend with my new milestone number:

- An $800k house if I pay a 50% down payment, or a $2 MILLION house if I pay a 20% down payment

- A nice house in a rural area with ALL CASH

- 200 nice vacations if each one costs $2k each

- Multiple luxury cars including a Lamborghini, Teslas, and a Mercedes

- Over 86,000 orders of chips and guac at Chipotle. That’s enough to order every day for the next 235 years.

My 2023 On the Blog

Blogging-wise, I’ve mostly maintained my one-article-a-month goal. The only months when I didn’t hit this were in May and December; I’ll give myself a pass for both, as in May I was traipsing around Europe and in December I was resettling from Massachusetts to California. My favorite post of the year was definitely about the net worth of the Count of Monte Cristo. I saw the opportunity to combine two topics I’m passionate about and grabbed at it with both hands!

Annoyingly, I had issues with the site a few months back when my site hosting service played musical chair with the servers. Now I can’t easily track how many visits my site gets, but I also don’t really care. I don’t care about becoming a famous blogger or raking in gobs of income from the site. Maybe another time I’ll fix this, but I’m in no rush to do so.

I just like that this does so much for me and for visitors.

Being a finance writer has also continued opening my friendship circle. I’ve had dinners and sleepovers with some of my closest friends; I’ve also gotten to visit some of these friends for the first time on my cross-country road trip.

This site is maybe the best hobby I’ve ever picked up with how much it’s given me. And not in the monetary sense, but in the priceless sense. This gives me a lovely outlet for writing, which I’ve always wanted to do and which I continue to love deeply. Now I’ve got me an “in” with the overall personal finance community, which gave me my current friendships and loads of potential friends to visit when I’m around their neck of the woods. Finally, it just feels really dang good to get messages from people I’ve helped or inspired with what I write here.

Here’s to four years at We Want Guac! Now time to see what the next year will bring!

Cover image credit: Michal Balog via Unsplash

Congratulations on hitting 4 years! And $400,000!

I suspect that you will soon hit the period where compounding interest starts accelerating your net worth, but we’ll have to wait and see what the next year brings.

Thank you!! I’m already seeing compound interest accelerate when I compare the time frame to how long it took to hit my first $100k. Back then, it took around 3 years during the long bull market run. This time took me 10 months. Utterly bonkers to think the time between each new milestone will only grow smaller !

Wow, you certainly are saving a lot! I don’t even understand what you are investing your money in when you could go from 300K in Mar 2023 to 400K when it is not even March this year. I do know that the risk-averse conservative person I am, I can never invest my money that way so I have peace of mind getting guaranteed money market and savings returns albeit awfully low. Anyway, glad you could get to this point so early in life, and am pretty confident next year at this time you will be singing that Bon Jovi song with well over 500K. You will be halfway there but definitely not living on a prayer due to your bold investments.

Oh friend, I’m investing in index funds!!! I would argue it’s the most conservative way to invest in stocks, given the overall performance that takes away a lot of the “gambling” aspects of stock picking. Here’s an old article I wrote about it if you’re interested: https://wewantguac.com/invest-in-index-funds-not-stocks/

And thank you for the kind words! Here’s to hoping I’ll see the growth continue on!

congrats I’ve been stopping by your blog every once in a while. great to hear about your steady progress, very inspiring!